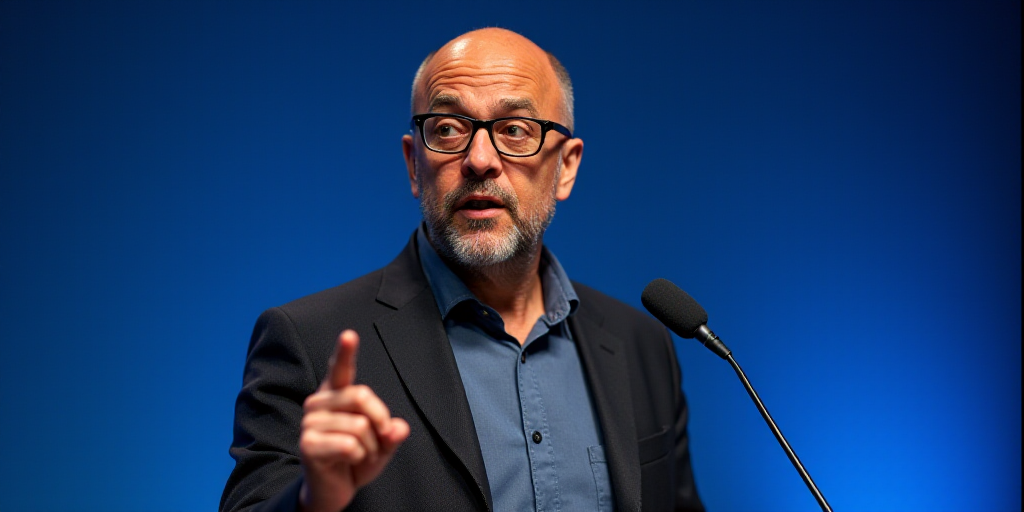

Background on Christopher Waller and the Federal Reserve (Fed)

Christopher Waller, a member of the Federal Reserve (Fed), has indicated that the US central bank might reduce interest rates in July, following four consecutive meetings where rates were kept unchanged. Waller’s comments come as the Fed maintains its benchmark interest rate within a range of 4.25% to 4.50% since the beginning of the year, despite President Donald Trump’s persistent calls for a rate reduction.

Waller’s Stance on Interest Rate Adjustments

In an interview with CNBC, Waller stated, “We could initiate the rate-cutting process and then, if there’s any significant turbulence due to the Middle East conflict, we could pause.” He further emphasized, “I believe we are at that position where we could do it, and by July.”

Waller highlighted that central banks should look beyond the effects of tariffs on inflation and focus on underlying trends in price increases. He also mentioned that if tariffs impact costs, he anticipates a “one-time level effect” that should not lead to persistent inflation.

Divided Opinions Among Fed Officials

Waller’s remarks come at a time when Fed officials appear increasingly divided on whether they can cut rates this year. Jerome Powell, the Fed Chair, noted last week that officials should wait to see how Trump’s tariffs affect the global economy, expecting more information during the summer.

“I think they would want to start slowly… But initiating the process is key,” Waller said, referring to the Fed’s approach.

The latest Fed Report on Monetary Policy to Congress mentioned that while US inflation is elevated and the labor market remains strong, tariffs might have started to impact. The report also reiterated that the Fed prefers waiting for more clarity before taking action on interest rates.

Addressing Trump’s Comments on Interest Rates

Regarding President Trump’s recent statements that lowering rates would help the country pay less interest on debt, Waller explained to CNBC that it is Congress’s and the Treasury Department’s responsibility to ensure a sustainable fiscal situation.

“Our Congressional mandate instructs us to focus on employment and price stability, which is exactly what we are doing,” Waller stated. “It does not tell us to provide cheap funding to the US government.”

Uncertain Impact of Tariffs on Inflation

The Fed Report to Congress acknowledged that the effects of increased tariffs on US consumer prices are uncertain, as trade policies continue to evolve. It also noted that it is still too early to assess how consumers and businesses will respond.

Key Questions and Answers

- What did Christopher Waller suggest about interest rates? Waller indicated that the Fed might initiate a rate-cutting process in July, depending on any significant turbulence caused by the Middle East conflict.

- Why is the Fed maintaining rates despite Trump’s calls for reduction? The Fed aims to focus on employment and price stability, as mandated by Congress, rather than providing cheap funding to the US government.

- How uncertain are the impacts of tariffs on inflation? The Fed Report to Congress acknowledges that the effects of increased tariffs on US consumer prices are uncertain due to evolving trade policies.