Reciprocal Tariffs by U.S. Affecting Global Economic Growth

The implementation of reciprocal tariffs by the United States against more than 70 countries has restarted the international trade system and become the primary risk factor for the global economy, according to Kristalina Georgieva, Managing Director of the International Monetary Fund (IMF), and Ajay Banga, President of the World Bank.

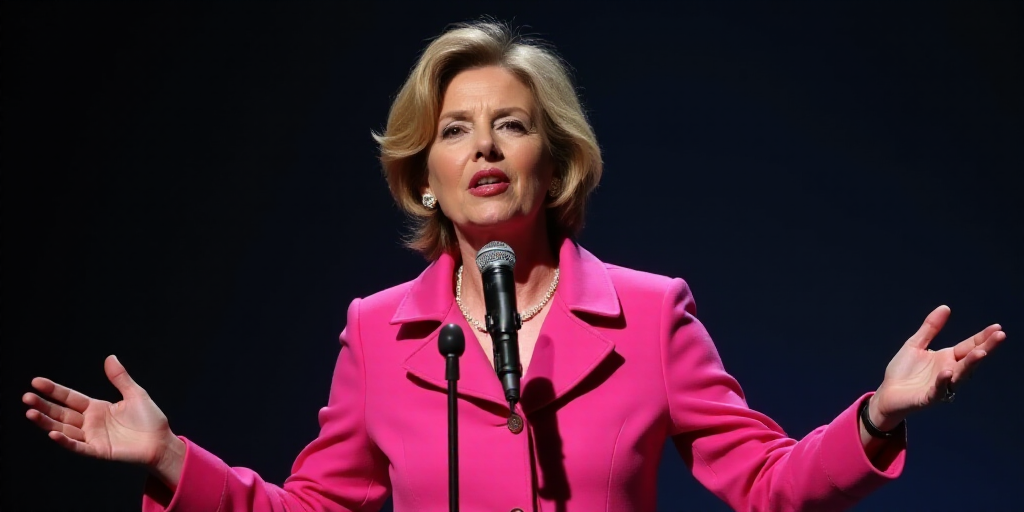

Georgieva’s Perspective

In separate conferences before the Spring Meetings of both organizations’ membership this week, Georgieva and Banga explained that trade tariffs are causing a slowdown in global economic activity, creating uncertainty for investors and disrupting complex supply chains.

Georgieva explained that trade tariffs have increased financial market volatility and anticipated that they will negatively impact current economic growth projections, which currently foresee a global slowdown.

On Tuesday, April 22, the IMF’s Chief Economist, Pierre Olivier Gourinchas, will present the updated global expectations contained in the flagship report, World Economic Outlook (WEO).

Georgieva warned that while a global recession is not expected due to the uncertainty, it does make investment planning more difficult. “The longer the uncertainty persists, the greater the cost to the global economy,” she stated.

Prior to the tariffs, the IMF had a global growth forecast of 3.3% for this year and next.

Banga’s Call for Broad Liberalization

In a separate conference, Banga emphasized the need for swift negotiation leading to broad liberalization rather than just preferential partners. This, he said, can help offset the economic risks.

“History shows that more open economies tend to grow faster and withstand market fluctuations better… Many developing economies maintain higher tariffs than developed ones, and prioritizing negotiation and dialogue will be crucial,” Banga noted.

Banga highlighted that reciprocal tariffs pose a greater risk of losing competitiveness for countries.

Tariffs and Their Consequences

Georgieva observed that both tariff and non-tariff barriers have become distortions in global trade, causing significant consequences. She considered recent tariff increases, pauses, escalations, and exemptions that have forced other countries to respond.

She added that this has had transboundary side effects, as “when advanced countries like China, the European Union, and the U.S. face off, smaller nations get caught in the crossfire.”

“Most emerging markets rely more on trade for growth and are thus more exposed, especially to tightening financial conditions,” she emphasized.

Protectionism undermines long-term productivity, directly impacts growth, and uncertainty affects supply chains composed of a wide range of national products, driving up prices in numerous countries.

Georgieva suggested strengthening countries’ domestic markets and competition while the global context resolves.

Broad Liberalization

Banga separately stressed that “broad liberalization, not just for preferential partners, can help offset these risks.”

It’s worth noting that the U.S. exempted Mexico and Canada from reciprocal tariffs but maintained a 25% duty on aluminum and steel from its partners, as well as similar tariffs for products exported outside the T-MEC agreement and automobiles and auto parts requiring a certain proportion of components produced in any of the three countries.

From Banga’s perspective, countries with export-driven growth models are currently the most vulnerable to trade disruptions.

He explained that in coordination with the IMF, they are preparing “a toolkit to address the trade context and maintain positive global productivity.”

This week marks the start of the IMF and World Bank Spring Meetings, where representatives from the 191 member countries, including Mexico, will participate.

Key Questions and Answers

- What are the concerns regarding trade tariffs? Trade tariffs imposed by the U.S. on more than 70 countries have increased financial market volatility and created uncertainty for investors, disrupting global supply chains and slowing economic growth.

- Who expressed these concerns? Kristalina Georgieva, Managing Director of the International Monetary Fund (IMF), and Ajay Banga, President of the World Bank, have both highlighted these concerns.

- How do tariffs affect global growth projections? Prior to the implementation of these tariffs, the IMF projected a global growth rate of 3.3% for this year and next. However, with the added uncertainty, these projections may change.

- What is the solution suggested by the IMF and World Bank? Both organizations suggest broad liberalization to offset economic risks, emphasizing the importance of open markets and dialogue for developing economies.

- Which countries are most vulnerable to trade disruptions? Countries with export-driven growth models, such as many developing economies, are currently the most vulnerable to trade disruptions.