Vacation Spending and Credit Card Debt

Ensure your beach vacation doesn’t turn into a financial nightmare. If you’ve returned from your sun, sand, and sea trip, it’s time to review your finances and see how your bank account looks after the Semana Santa holidays.

According to data from Bravo, a credit repair company, 40% of Mexicans primarily use credit cards to finance their vacations.

Due to the extensive use of credit cards during vacations, some individuals take between three and six months to pay off the accumulated debts from those relaxing periods.

By the time summer arrives, you’ll still be paying off your Semana Santa expenses without proper credit card management, potentially facing a snowball effect of mounting debts.

“Mexicans Often Rely on Credit for Vacations”

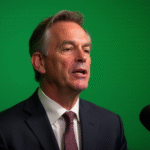

Luis Lucido, a financial education expert from Bravo, highlights that Mexicans frequently resort to credit cards or loans to finance their vacations. Consequently, after the holiday, it’s crucial to analyze available options for settling these debts.

Major Vacation Expenses

Among the most significant expenses during vacations are accommodation and recreational activities. Have you reviewed what was most costly during your relaxing days?

“Accommodation accounts for 43% of total vacation spending, while recreational activities can reach up to 20%,” explains the Bravo expert.

What to Do After Accumulating Debt

First, identify all the debts you incurred and their respective interest rates after using your credit card or taking out loans for your vacation, advises Luis Lucido from Bravo.

Once you know how much you owe and the interest rates, create a payment plan.

For credit cards, it’s essential to be a ‘totalista,’ meaning paying the full amount each month to avoid interest charges. Try to avoid minimum payments, as they imply paying interest to the bank.

Minimum payments might seem appealing as they help you meet your commitment, but remember that they come with interest charges. Use them only in emergencies.

If paying off your entire debt becomes challenging, some institutions offer the option to defer part or all of your balance over several months with interest. Carefully review any additional charges and determine if it’s beneficial for you.

Alternative Payment Methods

There are two methods to help you pay off your debts: the ‘snowball method’ and the ‘avalanche method.’ Both can accelerate your repayment process.

The avalanche method involves paying off debts with the highest interest rates first, while the snowball method prioritizes eliminating the smallest debt first to build motivation. Then, use that money to tackle the next debt.

“Remember, there’s no one-size-fits-all solution; it’s about analyzing your finances and choosing the best approach,” states Luis Lucido.

Currently, there are alternatives such as negotiating debt payments with financial institutions. For example, you can explore options like transferring debts to interest-free months or establishing a personalized monthly payment plan.

“For many Mexicans, negotiating and refinancing their debts is crucial to achieving financial stability and reducing economic burden. Therefore, it’s vital to understand your financial situation after the vacation period and make an informed decision on how to exit your debts,” emphasizes Bravo.

Key Questions and Answers

- What are the primary vacation expenses in Mexico? Accommodation and recreational activities account for 43% and 20% of total vacation spending, respectively.

- How long does it take Mexicans to pay off vacation debts? Many Mexicans take 3-6 months to pay off credit card debts accrued during their vacations.

- What should you do after accumulating vacation debt? Identify all debts, their interest rates, and create a payment plan. Prioritize paying off high-interest debts or the smallest debt first to maintain motivation.

- What are alternative payment methods for vacation debts? The snowball and avalanche methods can help accelerate debt repayment. Negotiating with financial institutions for better terms is another option.

- Why is understanding your financial situation important after vacations? It enables you to make informed decisions about debt repayment strategies and helps achieve financial stability.