Overview of the Mexican Stock Market Performance

The Mexican stock market has experienced its best six-day winning streak in two months, as risk appetite has decreased.

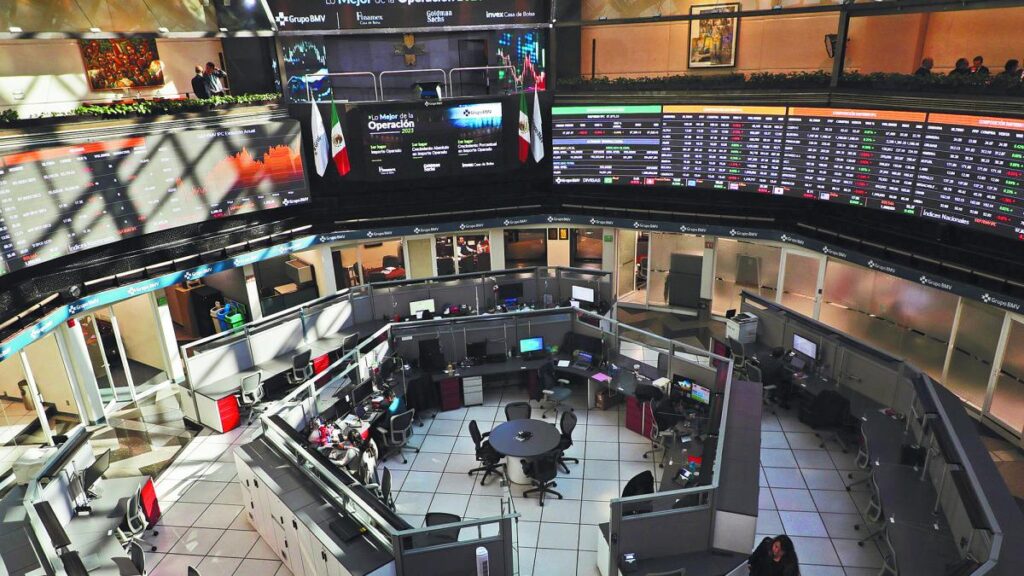

- The S&P/BMV IPC index of the Mexican Stock Exchange gained 1.80%, placing it at 55,766.58 points.

- The FTSE-BIVA index of the Mexican Institutional Stock Exchange also rose by 1.87% to 1,136.54 units.

Factors Driving the Market Uptick

Investor risk appetite increased after they absorbed President Donald Trump’s comments indicating less aversion to risk.

- International media reported that China’s tariff rate is expected to drop from 145% to between 50-65%, boosting global financial markets.

- President Trump’s milder stance towards Federal Reserve Chair Jerome Powell also provided relief to investors concerned about growing tensions between the two, which could increase uncertainty in an already volatile market.

Top Performers and Laggards in the Session

Qualitas Controladora led the session with a 9.49% gain, closing at 202.01.

- Banco Regional followed with a 6.88% increase, ending at 143.00.

- Grupo Financiero Inbursa rose by 6.46% to 52.39 pesos.

Wal Mart de México was the worst performer, falling 2.49% to close at 61.93 pesos.

- Peñoles dropped 1.47% to end at 421.49 pesos.

- GCC declined 1.06% to close at 169.04 pesos.

Debt Market Performance

In the secondary debt market, the yield on the 10-year bond fell seven basis points to 9.45%, while the 20-year rate remained unchanged at 10.16%.

Key Questions and Answers

- Q: Who is President Donald Trump and why is his stance relevant? A: President Donald Trump is the current president of the United States. His comments and actions have a significant impact on global financial markets, including Mexico’s stock market.

- Q: What is the significance of China’s tariff rate drop? A: The expected decrease in China’s tariff rate from 145% to between 50-65% has boosted investor confidence and contributed to the Mexican stock market’s positive performance.

- Q: How did the Mexican stock market indices perform during this period? A: The S&P/BMV IPC index gained 1.80%, while the FTSE-BIVA index rose by 1.87%.

- Q: Which companies were the top performers and laggards in the session? A: Qualitas Controladora led with a 9.49% gain, while Wal Mart de México was the worst performer, falling 2.49%.

- Q: How did the debt market perform alongside the stock market? A: The yield on the 10-year bond fell seven basis points, while the 20-year rate remained unchanged.