Background on the Mexican Peso and its Recent Performance

In 2025, the US dollar has weakened against strong currencies such as the euro, Canadian dollar, and Swiss franc. The Mexican peso has capitalized on this trend, appreciating to its best level in over a year.

According to data from Banco de México (Banxico), the Mexican peso closed the week with an appreciation of 3.45 centavos, or 0.19%, against the US dollar, reaching 18.4483 pesos per greenback. This marks the sixth consecutive day of gains against the US dollar.

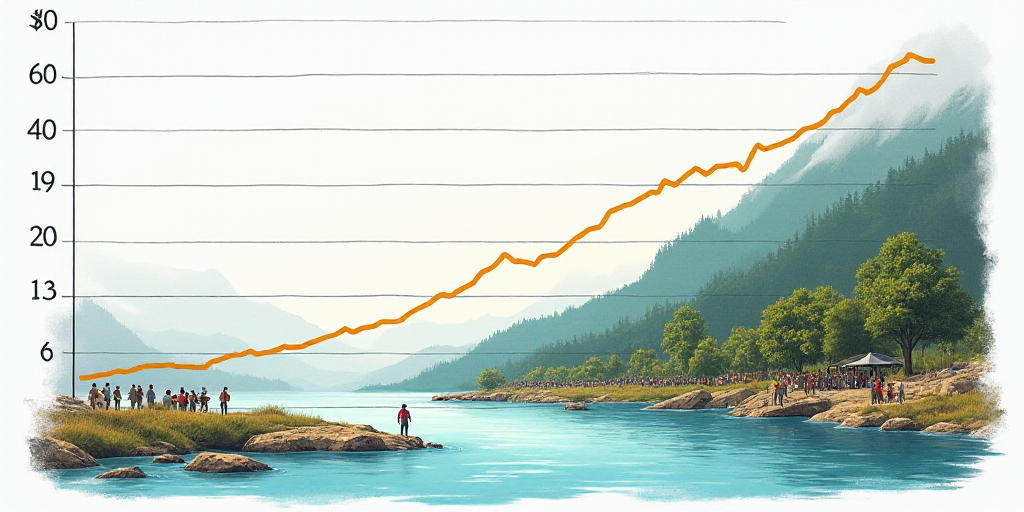

Weekly, the Mexican peso appreciated by 1.42%, its highest since the week ending August 8, 2025, when it gained 1.52%. Year-to-date, the peso has appreciated by 11.66%.

Experts’ Perspectives on the Peso’s Strength

Javier Bernal, director of Money Market at Monex Casa de Bolsa, attributes the peso’s strength to a weak US dollar and expectations of low interest rates. He states that this positive context for risk factors increases risk appetite, benefiting the peso.

Jorge Gordillo, director of Economic and Stock Market Analysis at CiBanco, highlights the peso’s low volatility as a decisive factor in its recent appreciation. Over the past eight months, the implied volatility of the peso has dropped from 10-14% to 7-9%. This decrease is beneficial for investors, encouraging participation in the ‘carry trade’.

Felipe Mendoza, analyst of Financial Markets at ATFX LATAM, supports the positive outlook for the Mexican peso, driven by the weakening US dollar and perceived internal stability. However, he acknowledges potential headwinds from weak production data and trade tensions with China in the medium term.

Expert Predictions for the Peso’s Future Performance

Experts anticipate that the Mexican peso may lose ground in the coming week, with expectations of a trading range between 18.40 and 18.60 pesos per US dollar.

ATFX LATAM analysts project the peso will fluctuate between 18.40 and 18.60 pesos per dollar, contingent on the Fed’s upcoming decision and speculation surrounding the currency.

Banorte experts forecast a peso trading range of 18.35 to 18.75 pesos per dollar, citing the dollar’s weakness as a relief for most currencies and the peso’s return below the psychological 18.50 pesos per dollar.

Monex expects the peso to oscillate between 18.41 and 18.50 pesos per dollar overnight, considering currency behavior and a modest economic agenda on Monday.

Weak Dollar Continues

The Intercontinental Exchange’s dollar index (DXY), which measures the US dollar against a basket of six strong currencies, fell 0.22% to 97.55 points during the week.

Year-to-date, the DXY has declined by 10.08%. The index is a weighted average of nominal exchange rates for six foreign currencies: the euro (57.6%), Japanese yen (13.6%), Canadian dollar (9.1%), British pound (11.9%), Swedish krona (4.2%), and the Swiss franc (3.6%).