Introduction to Delfina Gómez Álvarez

Delfina Gómez Álvarez, the first woman to govern Mexico State, the most populous entity in Mexico, is facing a challenging second year of her administration. Despite low approval ratings—25 points less than President Claudia Sheinbaum—her unique political style remains unchanged, halfway through her six-year term.

Gómez Álvarez’s Detachment from Mexico State Residents

Gómez Álvarez has distanced herself from the residents of Mexico State, missing two major road accidents in Atlacomulco and at the Concordia Bridge. Her absence sparked criticism, but her inaction regarding disputes among her cabinet members also drew complaints with escalating consequences.

The Looming Transportation Fare Hike

Within a week, Secretary of Government Horacio Duarte Olivares will attend the legislative body to fulfill his constitutional duty, while Gómez Álvarez will deliver a political message at the Teatro Morelos. Soon after, the difficult decision of adjusting public transportation fares will be implemented—an increase of three pesos.

This seemingly small increment could significantly impact millions of Mexico State residents who allocate a considerable portion of their income to transportation. In an entity marked by stark inequality and lengthy commutes that consume minimum wages, such a measure would be not only clumsy but also insensitive, posing a direct threat to the heart of Gómez Álvarez’s 4T project.

Political Turmoil and the Fare Hike Decision

The three-peso increase carries the signature of José Cosmares, who has become Gómez Álvarez’s primary operator. He conceded what Duarte Olivares and the mobility secretary refused: to harm the economy of millions of Mexico State residents.

Should the increase not occur within the next two weeks, transportation leader Odilón López and Luis Bernal from the Mexiquenses de Corazón movement—linked to Senator Higinio Martínez—will carry out their threats. Their strong economic interests in the transportation sector make this a high-stakes political situation.

Secondary Effects

Imposition?

The Fonacot has recently hired new providers for two key services: customer care and specialized debt collection for credit holders. Maysoft Global won the call center service contract for a semester, despite limited prior experience as a government provider, mainly in hardware and software support.

Positioning

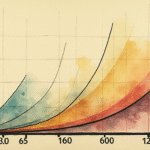

Post-pandemic, Mexico’s banking system has seen a reshuffle. Banco Mifel has experienced a 19% growth in assets and deposits, placing it 12th among Mexican banks. By targeting the market segment dominated by the “seven giants,” Mifel has demonstrated that size does not always equate to agility. Its capitalization index stands at 16.61%, and its ROE is 23.15%. The digital channel has been crucial in this progression, with over 400,000 clients and a doubling digital capture rate every two months. Mifel has effectively capitalized on the shift towards online banking.

Key Questions and Answers

- Is the fare hike an imposition? The recent hiring of Maysoft Global for customer care and debt collection services by Fonacot suggests a possible lack of experience in these areas, which might lead to concerns about the quality of service.

- What is Mifel’s position in the Mexican banking sector? Post-pandemic, Banco Mifel has experienced significant growth and now ranks 12th among Mexican banks. By focusing on gaining market share from the dominant “seven giants,” Mifel has shown that size is not always an indicator of agility.