Background on Key Players and Recent Developments

The financial markets usually focus on the Federal Reserve’s (Fed) monetary policy decision during the second day of the Federal Open Market Committee (FOMC) meeting. However, this time around, attention has shifted to who will be making these crucial decisions.

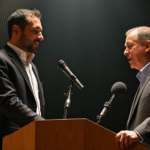

President of the United States has been keen on exerting control over the country’s central bank, and recently, in a dramatic turn of events, his advisor economic Stephen Miran was appointed as the new Fed governor by the Senate on Monday. Miran took office just before the two-day FOMC meeting began.

The position became vacant following the enigmatic resignation of Adriana Kugler, whose term was set to end in January 2026. However, she precipitously left her post in August without providing any explanation, leaving the spot open for a Trump ally.

Meanwhile, Lisa Cook confidently entered her role as a governor after Trump’s attempt to remove her through what would be known as an investigative file in other contexts failed due to the United States’ independent judicial system.

Potential Impact on Today’s Monetary Policy Decision

As of now, it appears that Trump has secured Miran’s vote but not Cook’s. If the situation remains unchanged by the time the monetary policy decision is announced, market expectations suggest a quarter-point reduction in the reference interest rate to 4.25%, aligning with 98% of market futures participants.

Morgan Stanley predicts a 25-basis-point reduction, while the CME FedWatch Tool assigns a 10% risk of a more significant 50-basis-point reduction.

Although the rate cut seems likely, all eyes will be on the Fed’s communication regarding future monetary policy decisions. The tone of the statement and the dot plot reflecting each FOMC member’s views will be crucial.

Market Reactions and Future Outlook

With market participants increasingly relying on gut feelings rather than clear signals, today’s decision will be closely scrutinized. The next FOMC meeting is scheduled for October 29, providing further insight into the majority’s stance within the US central bank.

Key Questions and Answers

- Who are the key players in this Fed drama? Stephen Miran and Lisa Cook are the newly appointed governors, with Miran being Trump’s loyal advisor and Cook having successfully defended her position against Trump’s attempts to remove her.

- What is the expected outcome of today’s monetary policy decision? Market expectations point to a quarter-point reduction in the reference interest rate, aligning with 98% of market futures participants.

- Why is the Fed’s communication so important? As market participants struggle to interpret clear signals, the tone of the statement and the dot plot reflecting each FOMC member’s views will guide future expectations.

- When is the next FOMC meeting, and why is it significant? The next FOMC meeting is scheduled for October 29. It will offer further insight into the majority’s stance within the US central bank and help shape future monetary policy decisions.