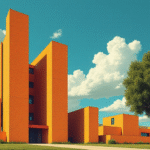

Key Cities Face Decreased Affordable Housing Development

The development of affordable housing in major cities across the country has significantly decreased, with urban hubs like Mexico City, Monterrey, and Guadalajara experiencing a reduction in new housing projects. Experts predict that this issue will worsen by 2026.

Historical Context and Relevance

Between 2016 and 2018, an average of 100 vertical housing projects were initiated per quarter in the Mexico City metropolitan area. However, this number has dropped to between 45 and 60 projects in recent years, indicating a slowdown in new housing offerings in one of the country’s primary urban markets.

Current Market Situation

Despite this trend, Mexico City remains the market with the highest volume of revenue from housing sales. In Q3 2025, 3,131 units were sold in Mexico City, generating gross revenue of 19,823 million pesos. Guadalajara followed with 15,390 million pesos, the Valley of Mexico with 10,799 million pesos, and Monterrey with 7,019 million pesos.

Justino Moreno, leader of Accumin Intelligence México, commented: “During the pandemic, 201 projects were initiated. Normally, Mexico City had inventory for 28 months, but now it oscillates at 20 months. This means that if all available units were sold today, it would cover the demand for 20 months in a market where prices reached 75,600 pesos per square meter.”

Permits: A Bottleneck in Housing Development

Enrique Téllez, co-director of Desarrolladora del Parque, warned that as inventories dwindle, housing prices will face increased pressure over the next two years.

Téllez highlighted that one of the main bottlenecks in the housing sector is obtaining construction permits and licenses, particularly in Mexico City where the process is “long and arduous.”

Building a 15-story residential building takes at least three years, and when considering preliminary procedures, a new property can take between four to five years to enter the market.

“Although authorities are making great efforts to provide certainty and reduce processing times, the number of projects in 2026 will be limited. There may be small-scale projects, but not necessarily at the desired pace,” Téllez added.

Financing and Investment Uncertainty

Financing adds to this scenario. The executive explained that many companies’ cash flows could be strained, especially in a year marked by uncertainty surrounding the renewal of the Trading Agreement between Mexico, the United States, and Canada (T-MEC), which also impacts housing investment decisions.

Trends Leading to 2026

Looking ahead to 2026, experts anticipate an increase in smaller-scale housing projects but with greater dynamism in mid-sized cities outside the major metropolises.

Moreover, the rising cost of housing for sale and shifts in consumer habits will drive growth in the rental market.

In the medium term, the sector remains optimistic about recovery: “I am convinced that by 2027, we will see an increase in the number of square meters constructed in the city,” Téllez concluded.

Key Questions and Answers

- What is the current situation with affordable housing development in major cities? The development of affordable housing has significantly decreased in major cities like Mexico City, Monterrey, and Guadalajara.

- Why is there a slowdown in new housing projects? The main bottleneck is obtaining construction permits and licenses, particularly in Mexico City where the process is lengthy.

- How will this slowdown impact housing prices? As inventories dwindle, housing prices will face increased pressure over the next two years.

- What trends are expected in the housing market leading to 2026? There will be an increase in smaller-scale housing projects in mid-sized cities, and the rental market will grow due to rising housing costs.

- What factors could impact housing investment decisions? Uncertainty surrounding the renewal of the T-MEC agreement between Mexico, the United States, and Canada could strain companies’ cash flows and impact housing investment decisions.