Introduction to Economic Development Poles (Prodecobi)

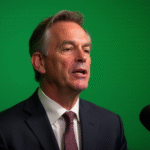

Mexico’s Secretary of Economy, Marcelo Ebrard, announced the alignment of Economic Development Poles for Well-being (Prodecobi) with Plan México. This initiative aims to establish at least one Prodecobi in each of Mexico’s states, offering tailored tax incentives based on individual needs.

Current Status of Prodecobi

- Four Prodecobi are currently under evaluation: ZM Mérida, Yucatán; Lázaro Cárdenas-La Unión de Isidoro Montes de Oca, Guerrero; Zona Carbonífera, Coahuila; and Hermosillo, Sonora.

- Nine Prodecobi are already operational in the Istmo de Tehuantepec region, led by the Mexican Navy.

- Two Prodecobi are in the licitation process: Tapachula I and II, Chiapas; and Teapa, Tabasco.

- Fourteen new Prodecobi have been authorized by President Claudia Sheinbaum.

- Additionally, 12 Prodecobi are in the evaluation phase, suggested by corresponding state governments.

Purpose and Benefits of Prodecobi

Prodecobi aims to stimulate the development of strategic economic sectors, territorial development in key regions, productive linkages, integration of small and medium enterprises (Pymes), increased national content, and shared prosperity through the economic and social effects of Plan México.

Tax Incentives for Prodecobi

According to Action 12 of Plan México, Prodecobi competitiveness will be supported through tax incentives to encourage new investments.

- Immediate 100% deduction for new fixed asset investments.

- Additional 25% deduction for training programs.

- Support for research and development initiatives with an additional 25% deduction.

Mexican companies investing in productive capacity and foreign companies relocating within the Prodecobi will participate in this initiative.

Key Questions and Answers

- What are Prodecobi? Economic Development Poles for Well-being (Prodecobi) are designated areas with specific infrastructure, targeted tax benefits, and administrative facilities aimed at fostering economic activity.

- How many Prodecobi are currently operational or under evaluation? Nine Prodecobi are already in operation, 14 have been authorized, four are under evaluation, and 12 are suggested by state governments for evaluation.

- What tax incentives are offered through Prodecobi? Tax incentives include immediate 100% deduction for new fixed asset investments, additional 25% deduction for training programs, and support for research and development initiatives with an additional 25% deduction.