Mexico Becomes Top Trading Partner for the U.S.

In the first seven months of 2025, Mexico has solidified its position as the United States’ top trading partner, accounting for 15.3% of total U.S. exports and imports. This is ahead of Canada (13.0%) and China (7.8%).

Trade Growth in 2025

The U.S. trade surplus with Mexico reached a new high of $112,587 million in July 2025, marking a 17.4% increase from the previous year. During this period, Mexican exports to the U.S. grew by 6.5%, totaling $309,749 million. Meanwhile, U.S. exports to Mexico increased by 1.1%, reaching $197,161 million.

July 2025 Trade Performance

In July alone, Mexican exports to the U.S. surged by 8.2%, totaling $45,366 million. This follows a 2.7% decline in April, a 5.6% increase in May, and a 6.3% rise in June.

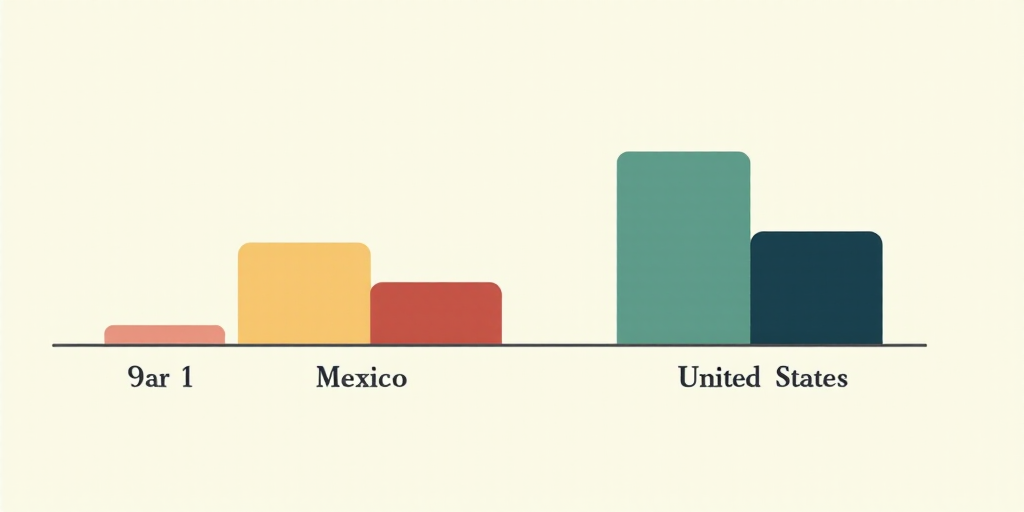

Comparison with Other Major Suppliers

Canada and China experienced interannual decreases in their exports to the U.S. in July 2025, with Canada selling goods worth $32,172 million (-10.4%) and China exporting $26,411 million (-35.3%).

Impact of Tariffs and Retaliations

Canada swiftly responded to the U.S. International Emergency Economic Powers Act (IEEPA) tariffs by imposing a 25% duty on $30,000 million Canadian dollars (approximately $22,000 million) worth of U.S. imports. Additionally, provinces and territories announced complementary measures, including restrictions on U.S. alcohol sales and adjustments in public sector hiring.

In response to U.S. tariffs on steel and aluminum, the Canadian government implemented retaliatory tariffs of 25% on U.S. imports equivalent to $29,800 million Canadian dollars (approximately $21,600 million). These measures aimed to balance the trade impact and safeguard the local economy.

Facing tariffs on automobiles, Canada imposed duties on non-compliant U.S. vehicles and those with insufficient T-MEC content. Simultaneously, Canada filed a complaint against the U.S. tariffs under Section 232 at the World Trade Organization (WTO).

To offset the economic impact, Canada announced tariff exemptions for certain U.S. imports in April 2025, benefiting strategic sectors and businesses within the country. These actions aimed to maintain market competitiveness and stability.

Starting September 1, Canada removed the retaliatory tariffs under IEEPA and some steel and aluminum tariffs, though it still imposes import taxes on U.S. vehicles and certain steel and aluminum quantities worth $15,600 million Canadian dollars (approximately $11,300 million U.S.).

U.S. Global Trade Deficit Rises in July

The U.S. trade deficit widened sharply in July, as record capital and other goods entries fueled imports. This trend, if sustained, could negatively impact GDP in the third quarter.

The trade gap surged 32.5% to $78,300 million in July, according to the U.S. Department of Commerce’s Office of Economic Analysis. Economists surveyed by Reuters had predicted a deficit increase to $75,700 million.

President Donald Trump’s aggressive tariffs have caused wild swings in imports and, ultimately, the trade deficit, distorting the overall economic picture.

A U.S. appeals court ruled on Friday that most of Trump’s tariffs, which have raised the country’s average tariff rate to its highest level since 1934, were illegal, adding more uncertainty for businesses.

Trade subtracted a record 4.61 percentage points from GDP in the first quarter before reversing sharply and adding 4.95 percentage points in the April-June quarter, also the largest contribution recorded.

The economy grew at an annualized rate of 3.3% in the last quarter, following a 0.5% contraction in the first three months of the year. Currently, the Atlanta Fed predicts a 3% GDP increase for this quarter.

Imports soared 5.9% to $358,800 million, with goods imports rising 6.9% to $283,300 million. This surge was driven by a $12,500 million increase in industrial supplies and materials imports, reflecting a $9,600 million rise in non-monetary gold.

However, oil imports were at their lowest since April 2021. Equipment imports increased by $4,700 million to a record $96,200 million, driven by computers, telecommunications equipment, and other industrial machinery. Yet, semiconductor imports fell by $800 million. Consumer goods imports rose by $1,300 million, while pharmaceutical preparations decreased by $1,100 million.

(Source: Reuters)