The Digital Transformation of Monthly Payments in Latin America

In a country where 85.2% of people still prefer cash for payments under 500 pesos, according to the National Financial Inclusion Survey (ENIF) 2024, digitalizing monthly payments represents not just a challenge but also a strategic opportunity.

Toku: A Key Player in the Latin American Financial Ecosystem

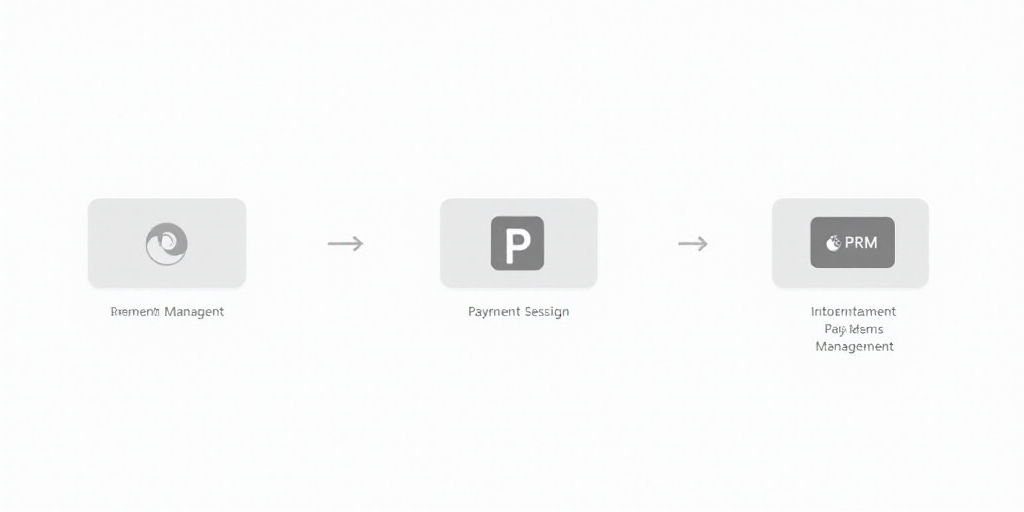

Against this backdrop, the fintech Tokyo emerges as a crucial protagonist in transforming the Latin American financial ecosystem. Their proposal: a new type of infrastructure that automates and manages the financial relationship between businesses and clients, under the concept known as PRM (Payment Relationship Management).

“PRM is to payments what CRM was for customer relationship management,” explains Francisca Noguera, Vice President of Sales in Mexico and co-founder of Tokyo. “We created our platform because there wasn’t a complete solution that would help businesses manage the entire financial relationship with their clients, from accepting a payment to actually collecting it.”

Understanding PRM and Its Impact on the Payment Landscape

Unlike traditional payment gateways, a PRM like Tokyo’s does not just process transactions; it orchestrates and automates the entire collection experience, from registering payment methods to intelligent retries in case of failures, automated reminders, bank reconciliation, and generation of integrated financial reports with systems like ERP and CRM.

- Automated retry of collections generates a +1.5% direct increase in revenue.

- Companies that previously only made 2 attempts per month can now make up to 5, effortlessly.

- Organizations with up to 40 people dedicated to manual reconciliation have eliminated this burden.

- Companies operating with up to 12 distinct payment methods now centralize everything in a single system.

Beyond operational efficiency, the PRM model addresses a structural need of Mexican businesses: improving their cash flow and reducing friction in the payment experience for their clients.

“With Tokyo, users have more payment options, greater convenience, and fewer chances of rejection. In Mexico, one out of every five card payments is rejected,” highlights Noguera, emphasizing how this friction negatively impacts customer retention and satisfaction.

Female Leadership Making History

Tokyo’s growth is undeniable. In April 2025, the company announced an extension of its Series A funding round to 48 million dollars, making it one of the most significant Latin American investment rounds led by a female founder. Cristina Etcheberry and Francisca Noguera are now regional fintech ecosystem trailblazers.

“Tokyo is building a new software category that solves an urgent and deep problem in Latin America. We are excited to support its expansion in Mexico,” said Allen Miller, a partner at Oak HC/FT, a US-based fund and lead investor in Tokyo’s Series A round.

The capital will accelerate Tokyo’s expansion in its primary markets: Mexico, Brazil, and Chile. Specifically in Mexico, the fintech already has a local sales team and active clients in key sectors like insurance, healthcare, education, credit, and real estate.

The Future of Payments: Invisible and Automated

Despite the challenges, the outlook is optimistic. “The big challenge is to make payments invisible. That you don’t even question whether you’re paying for a service,” reflects Noguera.

In a country where many businesses still operate with manual and fragmented processes, Tokyo aims to become the financial infrastructure of the future for Latin America.

“I see Tokyo as the definitive collection system for businesses. Companies should focus on their core business, and we will take care of this critical yet tedious part: collection.”

Key Questions and Answers

- What is PRM and how does it change the payment game? PRM (Payment Relationship Management) is a system that automates and manages the entire financial relationship between businesses and their clients, from accepting payments to collecting them. Unlike traditional payment gateways, PRM orchestrates and automates the entire collection experience, addressing structural needs of businesses like improving cash flow and reducing payment friction.

- Why is Tokyo significant in this context? Tokyo is a key player in the Latin American financial ecosystem, offering a comprehensive PRM solution that automates and streamlines the collection process for businesses. Their platform has shown to increase revenue, reduce manual workload, and improve customer experience.

- What does Tokyo’s funding mean for its growth? The recent Series A funding extension of 48 million dollars will accelerate Tokyo’s expansion in Mexico, Brazil, and Chile. This capital will support their growth in key sectors like insurance, healthcare, education, credit, and real estate.

- How does Tokyo envision the future of payments? Tokyo aims to make payments invisible and automated, focusing on improving cash flow for businesses and providing a seamless payment experience for clients.