Overview and Relevance of the Bank of Mexico’s Actions

The Junta de Gobierno of the Banco de México has revised its quarterly inflation forecasts in nine of the last thirteen monetary announcements, where it reduced interest rates to ease monetary constraints. Among these nine adjustments, the bank also raised its subjacent inflation forecasts and distanced its prediction for reaching the precise 3% inflation target in two instances.

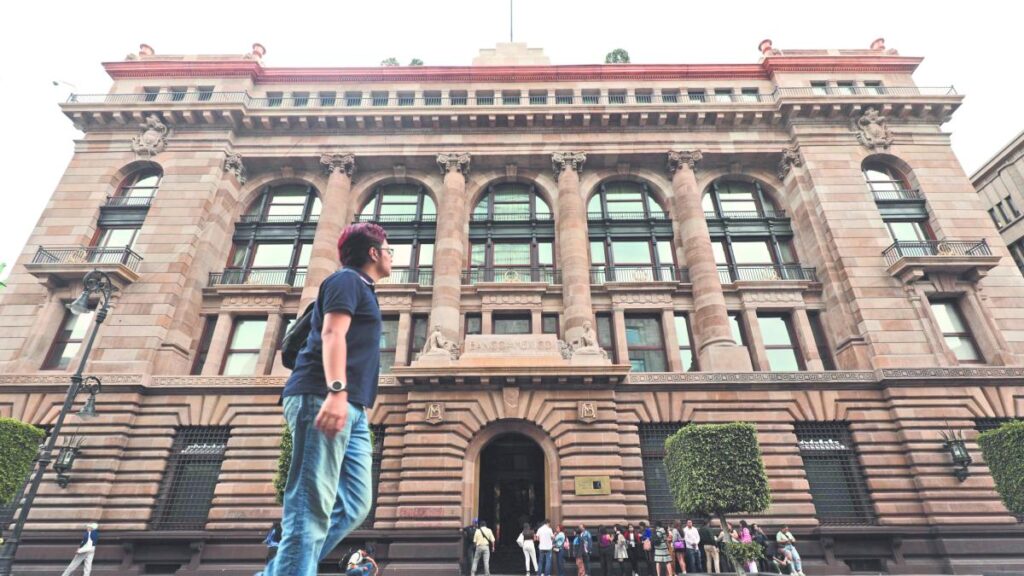

In a forecast-based inflation targeting regime, like the one implemented in Mexico since August 2018, publishing inflation forecasts aids the evaluation of a central bank’s performance in conducting monetary policy to achieve the inflation target within a specific timeframe.

Key Adjustments and Their Implications

At the start of the interest rate reduction cycle in March 2024, the Bank of Mexico projected that inflation would reach the target by the second half of 2025. However, this estimate was altered in November 2024’s monetary policy dedication when they forecasted the third quarter of 2026 for inflation to hit the 3% target.

Despite no changes to this projection since then, the bank adjusted its quarterly inflation forecasts in five monetary decisions (May, June, August) of 2025 and increased their subjacent inflation forecasts. The subjacent inflation, identified by monetary policy experts as the purest inflation indicator, excludes seasonal and administrative price variations.

The Role of the Junta in Forecast Creation

It’s essential to note that the inflation forecasts disclosed by the Banco de México in its monetary statements are crafted by the Dirección General de Investigación Económica, as explained by Governor Victoria Rodríguez Ceja during the last yearly conference presenting the Reporte de Estabilidad Financiera.

The process involves various directorates within the economic area, utilizing diverse economic variables impacting the inflationary landscape. Moreover, the creation of these forecasts must incorporate the judgment of the members of the Monetary Policy Committee, as per the 2018 Informe Trimestral’s explanation of the forecast-based inflation targeting regime.

Transparency and Communication Strategy

Under this scheme, high transparency levels and a strategic communication plan are crucial. This plan should include publishing inflation forecasts, their explanations, and detailed justifications.

Such transparency would enhance understanding of the response strategy, making the bank’s actions more predictable.

Key Questions and Answers

- Who creates the inflation forecasts? The Dirección General de Investigación Económica within the Banco de México is responsible for crafting these forecasts.

- How often has the Bank of Mexico adjusted its inflation forecasts? The bank has revised its quarterly inflation forecasts in nine out of the last thirteen monetary announcements.

- What is the significance of subjacent inflation forecasts? Subjacent inflation, which excludes seasonal and administrative price variations, is considered the purest inflation indicator by monetary policy experts.

- Why is transparency important in this context? High transparency levels and a strategic communication plan facilitate understanding of the central bank’s response strategy, making its actions more predictable.