Background on Banxico and its Importance

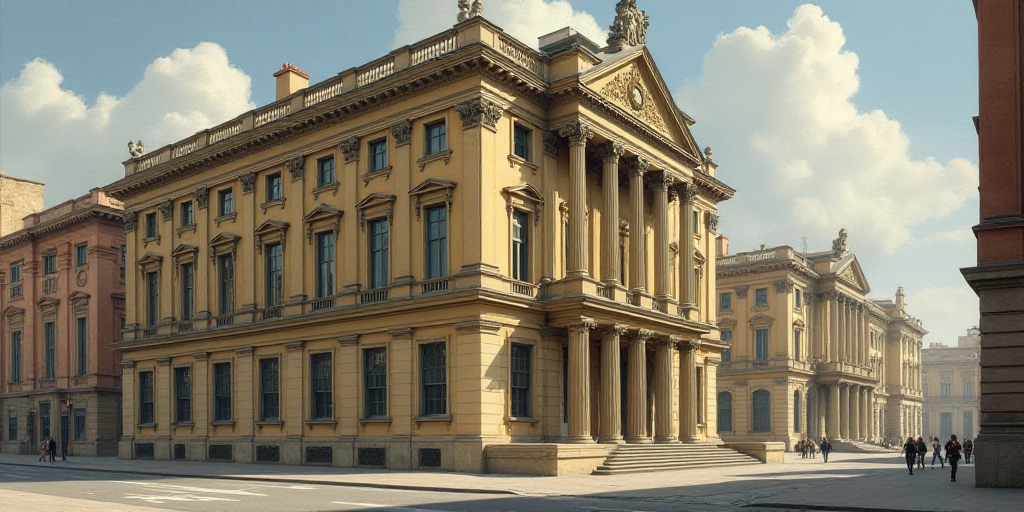

On August 25, 1925, the Bank of Mexico Act was promulgated, establishing a significant institution in the country’s economy. Current and past members of the Board of Governors agree that Banxico is not only a solid institution but also an anchor for Mexico’s economy, instilling national pride.

Global Challenges for Central Banks

Central banks worldwide have faced criticism and attacks. However, Banxico’s officials express confidence that their institution’s robustness will withstand these pressures.

Banxico’s Current Debate

Today, Banxico is at the center of a heated discussion regarding whether to extend its current mandate to include both inflation and employment targets.

Who is Banxico and Why is it Relevant?

The Banco de México (Banxico) is the central bank of Mexico, responsible for managing the country’s monetary policy. Established in 1925, Banxico plays a crucial role in maintaining price stability, promoting sustainable economic growth, and ensuring the stability of Mexico’s financial system.

As an independent institution, Banxico is accountable to the President of Mexico and the Federal Government but operates autonomously. Its decisions significantly impact interest rates, exchange rates, and overall economic conditions in Mexico.

The Debate: Inflation vs. Employment Targets

The current debate revolves around whether Banxico should expand its mandate to include employment targets alongside its traditional focus on controlling inflation. This shift would require the central bank to balance price stability with promoting job growth and reducing unemployment.

- Pros of Including Employment Targets:

- Promote a more comprehensive approach to economic management, considering both inflation and employment.

- Encourage sustainable economic growth by ensuring job creation alongside price stability.

- Increase public trust in Banxico’s ability to address broader economic concerns.

- Cons of Including Employment Targets:

- Risk of compromising price stability if employment targets take precedence over controlling inflation.

- Potential for increased complexity in decision-making processes, leading to slower responses to economic changes.

- Uncertainty regarding the effectiveness of targeting employment, as it is influenced by various factors beyond monetary policy.

Impact on Mexicans and the Economy

Banxico’s decisions directly affect Mexican citizens through interest rates, exchange rates, and overall economic conditions. By considering employment targets, Banxico aims to foster a more balanced and inclusive economic environment.

This potential shift could lead to:

- Lower unemployment rates and increased job opportunities for Mexicans.

- Sustainable economic growth that benefits various sectors of society.

- Greater public confidence in Banxico’s ability to manage the economy effectively.

Key Questions and Answers

- Q: What is Banxico? A: The Banco de México (Banxico) is Mexico’s central bank, responsible for managing the country’s monetary policy and ensuring price stability, sustainable economic growth, and financial system stability.

- Q: Why is Banxico expanding its mandate a topic of debate? A: The discussion centers on whether Banxico should include employment targets alongside its traditional focus on controlling inflation to achieve a more balanced economic approach.

- Q: What are the potential benefits of including employment targets? A: It could promote a more comprehensive economic management approach, encourage sustainable growth, and increase public trust in Banxico.

- Q: What are the potential drawbacks of including employment targets? A: There’s a risk of compromising price stability, increased decision-making complexity, and uncertainty about the effectiveness of targeting employment.

- Q: How will this debate impact Mexicans and the economy? A: If Banxico successfully balances inflation and employment targets, it could lead to lower unemployment rates, sustainable economic growth, and greater public confidence in the central bank.