The Current Economic Landscape

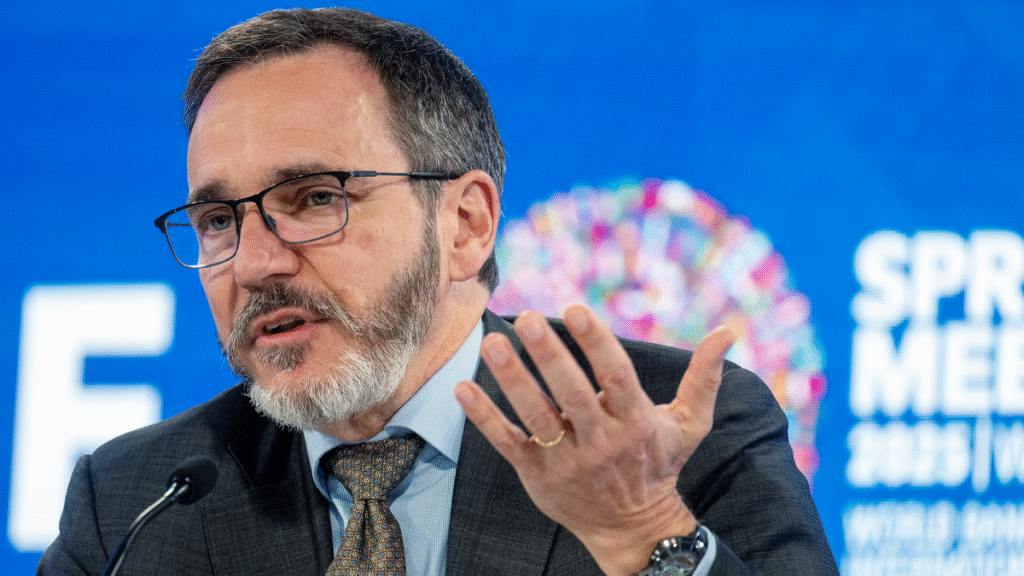

According to Pierre Olivier Gourinchas, the Chief Economist of the International Monetary Fund (IMF), the global economy is facing a double blow that pushes down growth expectations. This is due to the tariffs being imposed by the United States on its trading partners and the uncertainty surrounding future trade policies.

IMF’s Global Economic Outlook

Presenting the World Economic Outlook (WEO), Gourinchas projected a 2.4% growth for the global GDP this year, an upward revision from the 2.2% forecasted in January. However, he warned that uncertainty plays a significant role in these projections.

Impact on Key Economies

The IMF’s Chief Economist noted that while tariffs have an impact, uncertainty about future trade policies weighs more heavily. He emphasized that immediate improvements in global growth prospects could occur if countries relax their current trade policies and foster a stable investment environment.

The IMF does not foresee a recession risk for the U.S. economy, despite a 40% increase in recession probability since the fall, from 25%. The U.S. economy was in a healthy position before the sudden tariff hikes that sparked uncertainty.

Most Affected Economies

According to the WEO, the most affected economies due to tariffs are China, Mexico, Canada, and the U.S. The impacts will vary in magnitude and scope.

- For the U.S., there’s a restructuring of supply chains causing inflation to rise and growth to fall. The price index is expected to return to March 2021 levels of 4%.

- China is projected to grow by 4% this year, down from the previous estimate of 4.6%.

- Canada is expected to grow by 1.4% this year, below the initial 2% projection for 2025.

- Mexico is anticipated to contract by 0.3%.

Latin America and Consumption as a Driver

The updated projections for Latin America’s economy show a 2% growth this year and 2.4% for the next, both below previous estimates of 2.5% and 2.7%, respectively.

The IMF’s Chief Economist explained that the economic momentum is driven by consumption, thanks to resilient labor markets. Investment remains sluggish, and the regional deceleration reflects tariff impacts and reduced global activity.

- Argentina is expected to be the most dynamic economy with a 5.5% growth rate, though it cannot offset Brazil’s slower performance, projected at 2%, and Mexico’s anticipated contraction of 0.3%.

Key Questions and Answers

- Q: Is the U.S. economy at risk of recession? A: The IMF does not consider the U.S. economy to be at risk of recession, as it was in a healthy position before the tariff hikes that caused uncertainty.

- Q: How are tariffs affecting global growth? A: Tariffs are causing supply chain restructuring, pushing inflation up and growth down. The U.S. is experiencing this with a projected return to 4% inflation levels.

- Q: Which economies are most affected by tariffs? A: The WEO identifies China, Mexico, Canada, and the U.S. as the most affected, with varying impacts.

- Q: What is driving Latin American economic growth? A: Consumption, backed by resilient labor markets, is the primary driver. Investment remains slow, and growth projections have been revised downward due to tariffs and reduced global activity.