Background and Relevance of the Tax Authority

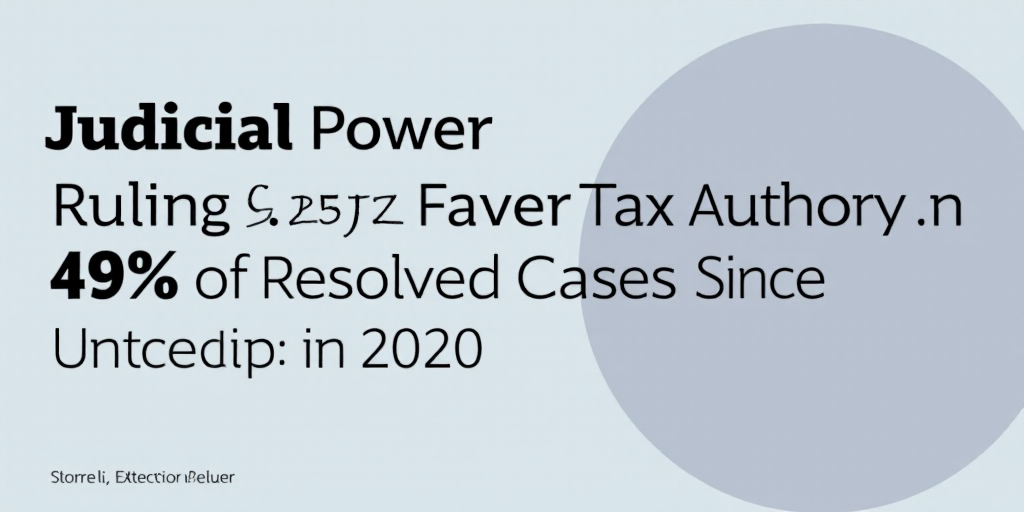

The Mexican tax authority has been successful in 49% of the resolved cases at definitive instances since 2019, according to official information. This highlights the tax authority’s effectiveness in enforcing tax laws and collecting revenue.

Detailed Statistics of Tax Cases

From January 2019 to March 2025, a total of 111,521 tax cases were resolved at definitive instances, with disputed amounts totaling 1.077 trillion pesos, as reported by the Secretariat of Finance and Public Credit to the Chamber of Deputies.

- Tax Authority Wins: The federal tax authority won 54,918 cases, amounting to 762,549 million pesos, which represents 49% of all cases and 71% of the total disputed capital.

- Contributors’ Wins: In 42,919 cases, the judicial power sided with taxpayers, resulting in losses for the federal tax authority. These cases involved disputed amounts of 262,577 million pesos.

- Nulity Resolutions: During the same period, 13,684 cases were resolved with nulity for effects, involving 52,327 million pesos.

A nulity resolution for effects allows the tax authority to maintain its powers in determining and collecting disputed credits through indirect amparo proceedings before the Federal Judicial Power (PJF).

President Sheinbaum’s Assurances on the New Judicial Power

President Claudia Sheinbaum has reassured taxpayers that the new judicial power, resulting from the recent elections on June 1, will be “much better” than the current one. These statements come as the existing Supreme Court of Justice of the Nation (SCJN) resolves several tax refund litigations before its renewal with newly elected justices.

Sheinbaum expressed her confidence in the new judges, magistrates, and ministers, stating that they will act within the law, unlike the current situation marked by exceptions and alleged corruption.

Expert Opinions on Tax Authority’s Wins

Juvenal Lobato, a tax law professor at the National Autonomous University of Mexico (UNAM), clarified that winning a tax case does not guarantee the collection of tax credits. The tax authority still needs to execute the collection process, and contribuyents may seek international legal avenues to challenge the ruling or face situations where companies no longer have funds by the time the case concludes.

SCJN to Postpone 65 Tax-Related Cases

The Supreme Court of Justice of the Nation (SCJN) has approved a request by the federal government to postpone resolving a contradiction of criteria related to revocation resources until the new court, resulting from the June 1 judicial elections, begins its functions.

- Impact: This postponement will affect up to 65 tax-related cases concerning the payment of corporate taxes.

- Voting Proposal: The SCJN will vote on a proposal by Minister Batres to have fiscal cases in both courtrooms decided by the full court in transparent and public sessions.

Key Questions and Answers

- Q: What does it mean when the tax authority wins a case?

A: Winning a tax case does not guarantee immediate collection of tax credits; the tax authority must still execute the collection process. - Q: How many tax cases has the judicial power ruled in favor of the tax authority since 2019?

A: The judicial power has ruled in favor of the tax authority in 49% of the resolved cases since 2019, totaling 54,918 cases and 762,549 million pesos. - Q: What is the significance of nulity resolutions for effects?

A: Nulity resolutions for effects allow the tax authority to maintain its powers in determining and collecting disputed credits through indirect amparo proceedings before the Federal Judicial Power (PJF). - Q: How many tax-related cases will be postponed by the SCJN?

A: The SCJN will postpone resolving up to 65 tax-related cases until the new court begins its functions.