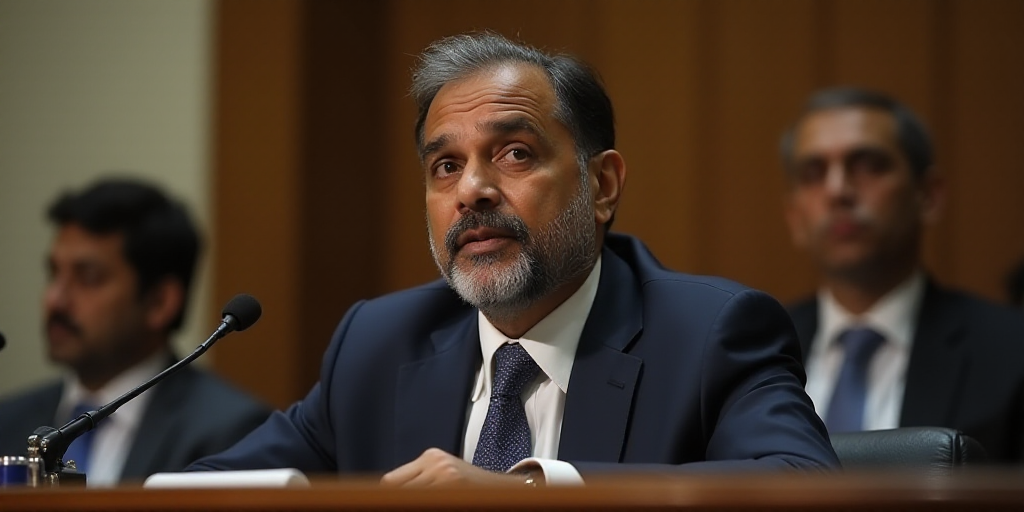

Background on the Speaker

Francisco Chíguil is a senator representing the Morena party in Mexico. His political stance and position as a senator make his opinions on tax reform significant, especially concerning the Mexican economy.

The Need for Comprehensive Tax Reform

Senator Chíguil asserts that Mexico requires a comprehensive tax reform; however, he claims that such changes have not been implemented due to fears and the government’s intent to provide economic sectors with certainty.

Slow Fiscal Policy and Targeted Sectors

Chíguil emphasized that fiscal policy has been sluggish, with only increased oversight for large contributors achieved in six years. Meanwhile, medium-sized businesses and companies remain lagging behind.

Potential Revenue from Taxing Medium-Sized Enterprises

The senator highlighted that taxing medium-sized enterprises would yield substantial revenue, estimating between 200,000 and 300,000 million pesos. This is based on the fact that there are over 10,000 such companies, many of which evade taxes.

Tax Reform Proposal for Alcoholic Beverages

During a discussion organized by the Colegio de México, Chíguil addressed a study proposing tax reform for alcoholic beverages. The research, conducted by Gerardo Esquivel and Williams Peralta, suggests revising the tax scheme for these beverages.

Current Tax Structure and Proposed Changes

Currently, Mexico imposes two taxes on alcoholic beverages: the Impuesto Especial sobre Producción y Servicios (IEPS) and the Value Added Tax (VAT). The proposed reform focuses on altering how the IEPS is collected.

Under the current IEPS law, this tax is levied using percentage rates applied to the final price of alcoholic beverages, making it an ad valorem tax. The Colegio de México’s proposal suggests switching to an ad quantum system, where the tax is based on a fixed rate per liter of commercialized alcohol.

Potential Benefits of the Proposed Reform

According to Gerardo Esquivel, who presented the study’s findings, implementing this proposal could increase tax revenue from alcoholic beverages while simultaneously reducing tax evasion and potentially lowering the final prices of these products.

Key Questions and Answers

- What is the main issue discussed? Senator Chíguil emphasizes the need for comprehensive tax reform in Mexico, citing concerns and governmental hesitance as obstacles.

- Which sectors are targeted for tax reform? Medium-sized businesses and companies are highlighted as areas requiring increased fiscal oversight.

- What is the estimated revenue from taxing medium-sized enterprises? The research suggests that taxing these companies could generate between 200,000 and 300,000 million pesos.

- What changes does the proposed tax reform for alcoholic beverages suggest? The proposal recommends shifting from an ad valorem IEPS system to an ad quantum system based on a fixed rate per liter of commercialized alcohol.

- What benefits could result from implementing the proposed tax reform? Increased tax revenue, reduced tax evasion, and potentially lower prices for alcoholic beverages are anticipated outcomes.