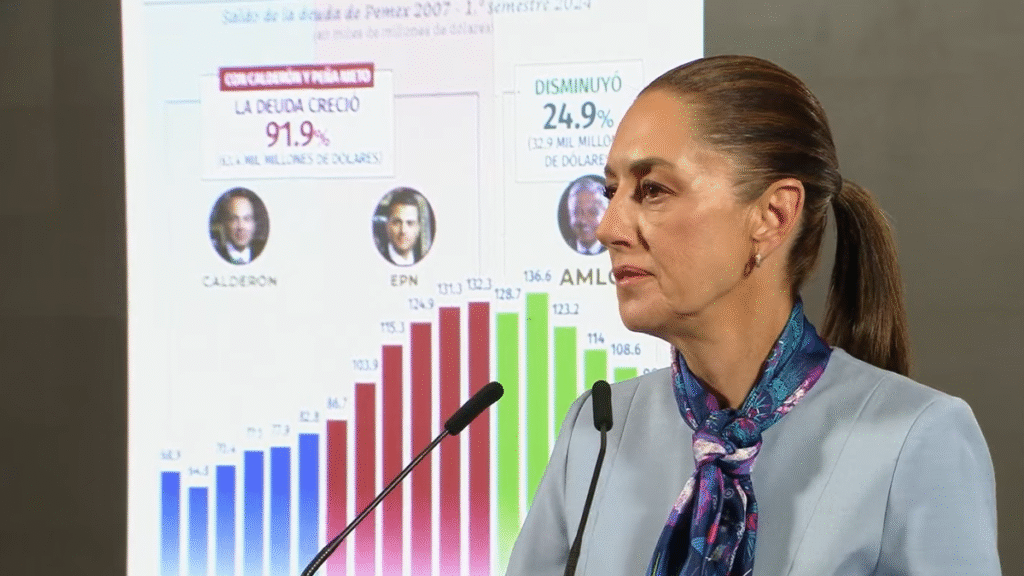

Background on Claudia Sheinbaum and Her Relevance

Claudia Sheinbaum is the current Head of Government (equivalent to Mayor) of Mexico City, serving since 2018. As the successor to former mayor Marcelo Ebrard, she took office during a period of significant political change and economic challenges in Mexico. Sheinbaum, a seasoned politician with a background in science and environmental issues, has been instrumental in shaping Mexico City’s policies on sustainability, public transportation, and social programs.

Understanding Mexico’s Government Debt

The International Monetary Fund (IMF) has reported that, in the first year of Claudia Sheinbaum’s administration, Mexico’s overall government debt will reach 60.7% of the country’s Gross Domestic Product (GDP). This figure marks the highest level in the past six years.

Components of Mexico’s Government Debt

Mexico’s government debt comprises obligations from the central government, social security funds, public enterprises, development banks, the National Infrastructure Fund, and the National Insurance and Guarantee Corporation.

Comparison with Emerging Economies

Although Mexico’s debt-to-GDP ratio will be 60.7%, it remains below the average of emerging economies, which is approximately 73.6% of GDP.

IMF Projections and Key Factors

According to the IMF’s semi-annual Fiscal Monitor, Mexico’s debt is projected to peak at 61.1% of GDP by 2026 and remain stable until at least 2030. The increase in debt is primarily due to higher interest payments and the rising cost of borrowing, resulting from tightened credit conditions caused by tariffs.

Upcoming IMF Discussions

The latest edition of the Fiscal Monitor, which will serve as the basis for discussions among the 191 IMF member countries and the World Bank during the upcoming Spring Meetings in Washington D.C., is currently underway.

Key Questions and Answers

- What is the current debt-to-GDP ratio under Claudia Sheinbaum’s administration? The debt-to-GDP ratio is projected to reach 60.7%.

- Which components make up Mexico’s government debt? The debt includes obligations from the central government, social security funds, public enterprises, development banks, the National Infrastructure Fund, and the National Insurance and Guarantee Corporation.

- How does Mexico’s debt-to-GDP ratio compare to other emerging economies? Mexico’s ratio is below the average of 73.6% for emerging economies.

- What factors are driving the increase in Mexico’s government debt? The rise is primarily due to higher interest payments and the escalating cost of borrowing, resulting from stricter credit conditions caused by tariffs.

- When is the IMF’s Fiscal Monitor discussion scheduled? The Spring Meetings, where the Fiscal Monitor will be discussed, are set to begin on Thursday in Washington D.C.