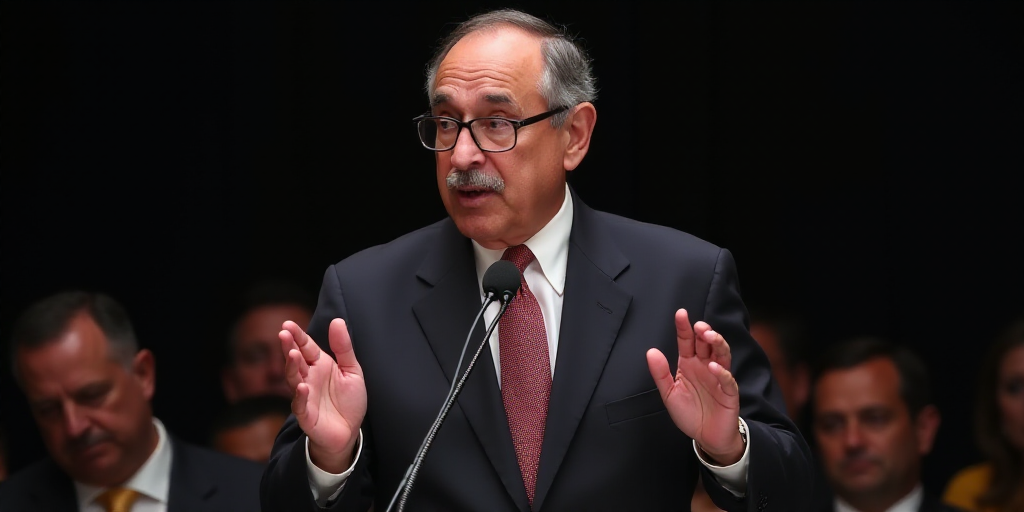

Background on Stephen Miran and His Role at the Fed

Stephen Miran, Governor of the Federal Reserve (Fed), has once again pushed for an aggressive policy of rate cuts, citing the impact of the Trump administration’s economic policies. This stance contrasts with other Fed officials who advocate for a more cautious approach, citing lingering inflationary pressures.

Miran’s Perspective on Rate Cuts

In an interview with Bloomberg, Miran stated, “If the policy is out of balance, it needs to be adjusted at a reasonably rapid pace.” He emphasized that while the current interest rate policy setting hasn’t yet reached a critical point, prolonged maintenance of these levels could lead to significant problems within a year.

Miran’s conviction for more flexible monetary policy stems from his belief that economic shifts, particularly in immigration, suggest a decrease in the so-called neutral interest rate. This implies that if the Fed’s policy remains near current levels, it could become more restrictive for growth, according to Miran.

Recent Developments and Upcoming Fed Meetings

Miran spoke on the day the government was supposed to release its latest employment sector report, but the report wasn’t published due to the budget impasse among elected leaders. Miran didn’t express concern over missing crucial data, stating that the Fed still has time before its next meeting in late October.

Divergent Views Among Fed Officials

Miran is the newest Governor at the Fed and an unusual case, as he serves in a reduced capacity under President Trump. During the previous Federal Open Market Committee meeting where interest rates were set, Miran dissented and advocated for a half-percentage point cut. Subsequently, the officials reduced the target range for the federal funds rate by a quarter percentage point to between 4.0% and 4.25%, attempting to balance reducing high inflation with supporting a weakened labor market.

The officials also anticipate further rate reductions and expect the target interest rate to be between 3.5% and 3.75% by year-end, with a move between 3.25% and 3.50% by 2026.

Concerns Over Service Inflation

In comments to CNBC, Chicago Fed President Austan Goolsbee expressed concern over the recent uptick in service inflation while wage job creation has weakened. He stated, “We’re in a somewhat delicate situation” as recent data shows rising service inflation, which likely isn’t due to tariffs.

Lorie Logan, President of the Dallas Fed, maintained a cautious stance, declaring that “we really need to be cautious about any further rate cuts from here on out” given ongoing concerns over non-housing service inflation.

Key Questions and Answers

- Who is Stephen Miran and what is his role at the Fed? Stephen Miran is a Governor of the Federal Reserve. He recently joined the Fed and has taken a more aggressive stance on rate cuts compared to other officials.

- What are the differing opinions among Fed officials? While Miran advocates for aggressive rate cuts due to Trump’s economic policies, others like Austan Goolsbee and Lorie Logan express caution, citing concerns over inflation and its impact on the labor market.

- What are the potential implications of these differing views? The conflicting opinions could lead to varying policy decisions, potentially affecting economic growth, inflation, and employment levels.