Background on Jerome Powell and the Federal Reserve

Jerome Powell, appointed by former President Donald Trump in late 2017 to lead the Federal Reserve (Fed), has been under increasing scrutiny from Trump. Powell was initially nominated for a four-year term and later renominated by President Joe Biden for another term, set to conclude on May 15, 2026. The Federal Reserve Act has long upheld that the Fed chair cannot be dismissed for political differences, only “for cause.”

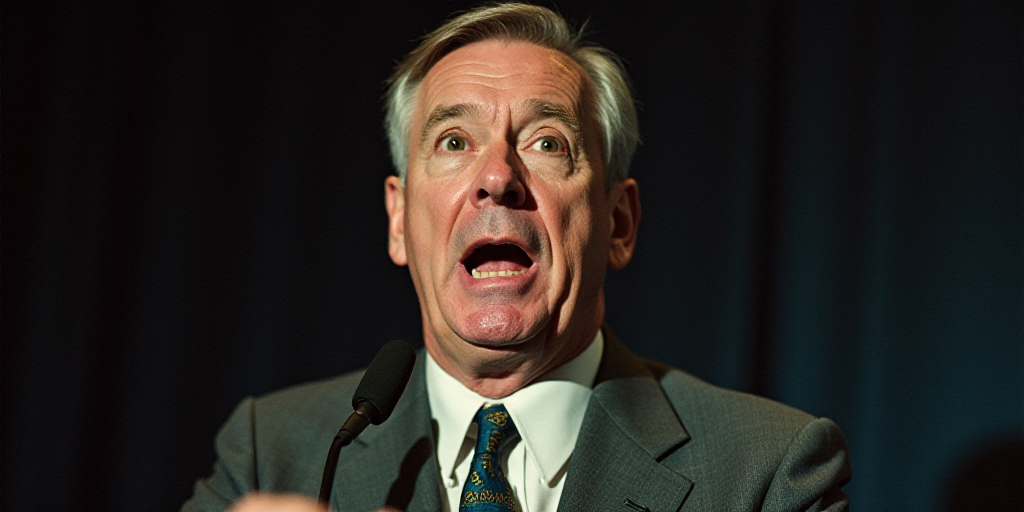

Trump’s Recent Statements and Criticisms

In a recent interview, Trump stated that he does not plan to fire Powell immediately but did not rule out the possibility. Trump has been critical of Powell almost daily, accusing him of being “too late” in cutting interest rates. Trump mentioned that he brought up the idea of firing Powell to Republican lawmakers on Tuesday night, marking another chapter in his ongoing campaign against the independent Fed and its troubled president.

Trump suggested that firing Powell would only be considered if there were evidence of fraud, referring to recent criticisms from the White House and Republican lawmakers about alleged overspending in the $2.5 billion renovation of the Fed’s historic headquarters in Washington. No fraud has been proven, and the Fed has refuted these criticisms.

Impact on Markets and Powell’s Stance

A Bloomberg report on Wednesday suggesting Trump might soon fire Powell caused a drop in stocks and the US dollar, while Treasury bond yields rose. Powell has maintained his intention to complete his term, despite Trump’s persistent criticism of keeping the policy interest rate within the 4.25–4.50% range since December, as the Fed evaluates the impact of significantly higher tariffs on inflation.

Trump blames the Fed for rising long-term interest rates, which increase the cost of US government loans. His attacks on Powell have continued since signing the “Great and Beautiful Tax Cuts and Jobs Act” on July 4, which independent analysts say will add trillions to the US deficit.

Support for Fed Independence from Republican Senator

Thom Tillis, a Republican senator from North Carolina who opposed the tax bill and later announced he would not seek re-election, defended an independent Fed in a recent statement. Economists assert that the Fed is crucial to maintaining financial and price stability in the United States.

“There have been discussions about dismissing the Fed chair,” Tillis said. “The consequences of removing a Fed chair simply because politicians disagree with an economic decision would undermine the credibility of the United States in the future, and I would say that such an outcome would prompt a rather immediate response, which we must avoid.”

Key Questions and Answers

- Q: Will Trump fire Powell immediately? A: Trump stated that he does not plan to fire Powell right away, though he did not rule out the possibility.

- Q: What has Trump criticized Powell for? A: Trump has criticized Powell for not cutting interest rates sooner and maintaining the policy interest rate within the 4.25–4.50% range, despite rising inflation concerns.

- Q: What would be the implications of firing Powell? A: Senator Tillis warned that dismissing the Fed chair for political reasons would damage US credibility and likely prompt an immediate response.