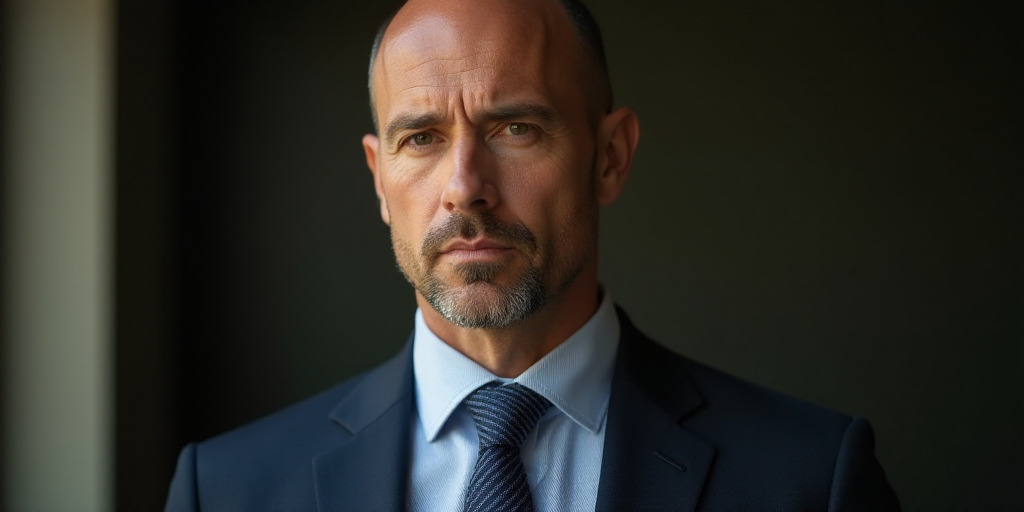

Background on Germán Larrea and Grupo México

Germán Larrea Mota Velasco, the second-richest man in Mexico with a net worth of approximately $28 billion, is the owner and president of Grupo México. This conglomerate spans various sectors, including mining, transportation, and infrastructure. Larrea’s prominence in the mining industry earned him the nickname “King of Copre,” as Grupo México is a leading global copper producer.

Grupo México’s Interest in Banamex

On a surprising turn of events, Grupo México announced its interest in acquiring 100% of Banamex, a Mexican bank currently owned by Citigroup. This move comes despite recent agreements between Fernando Chico Pardo and Citi, where Chico Pardo was set to acquire 25% of Banamex and become its board president.

Details of Grupo México’s Offer

Grupo México outlined its proposal in a communication sent to the Mexican Stock Exchange (BMV). The offer aims to achieve two primary goals: acquiring 100% of Banamex and ensuring that the bank is majority-owned by Mexican entities. The proposal includes purchasing up to 100% of the bank’s shares at specific multiples of its book value (VL):

- 25% of the capital at a multiple of 0.85x VL

- 75% of the remaining capital at a multiple of 0.80x VL

However, Grupo México stated that if Fernando Chico Pardo and his family wish to maintain their 25% investment with Citi, the offer would only acquire 75% of Banamex at a multiple of 0.80x VL.

Grupo México emphasized that if the Chico Pardo family decides to keep their investment, their rights as minority shareholders would be respected.

Potential Impact on Banamex and Mexican Economy

Grupo México believes that acquiring Banamex would strengthen credit access for Mexican families and businesses. If accepted by Citi, the offer would subject to necessary approvals.

The company highlighted that once Banamex is fully regulated by Mexican financial authorities, it could regain its competitive edge in the Mexican financial system and contribute significantly to the country’s economic development.

Grupo México also prioritized preserving Banamex’s workforce, maintaining and leveraging the directors’ expertise, ensuring a smooth transition for clients. Additionally, they committed to keeping Banamex’s extensive Mexican art collection and preserving its colonial buildings as part of the valuable cultural heritage.

Citi’s Response

Later the same day, Citigroup released a statement regarding Grupo México’s communication. Citi mentioned that, as of then, they had not received a formal offer from Grupo México to acquire 100% of Banamex.

Citi clarified that if they received such an offer, it would be reviewed responsibly, considering factors like regulatory approval and transaction certainty. Nonetheless, Citi reaffirmed its commitment to maximizing Banamex’s total value for its shareholders, and the agreement with Fernando Chico Pardo remains their preferred path to achieve this goal.

Key Questions and Answers

- What is Grupo México’s proposal? Grupo México aims to acquire 100% of Banamex, with specific multiples for different percentages of the bank’s capital based on its book value (VL).

- What happens if Fernando Chico Pardo wants to keep his 25% investment? Grupo México stated that they would respect Chico Pardo’s minority shareholder rights if he decides to maintain his 25% investment in Banamex.

- What are the potential benefits of Grupo México acquiring Banamex? Grupo México believes this acquisition would enhance credit access for Mexican families and businesses, strengthen Banamex’s competitive position in the Mexican financial system, and contribute to the country’s economic development.

- What was Citi’s response to Grupo México’s proposal? Citi stated that they had not received a formal offer from Grupo México. If they do, Citi will review it responsibly while considering factors like regulatory approval and transaction certainty.