Banco Santander México’s Commitment to Small and Medium Enterprises (SMEs)

Banco Santander México acknowledges the current period of high uncertainty, primarily due to trade-related issues. However, they remain optimistic that Mexico will emerge stronger. The bank is particularly focused on supporting small and medium enterprises (SMEs), a segment they feel comfortable in and prioritize.

Part of the Mexico Plan by the Federal Government

As part of the Mexico Plan by the Federal Government, it is expected that 30% of SMEs will have access to formal financing by 2030. This initiative will be presented at the upcoming 88th Banking Convention.

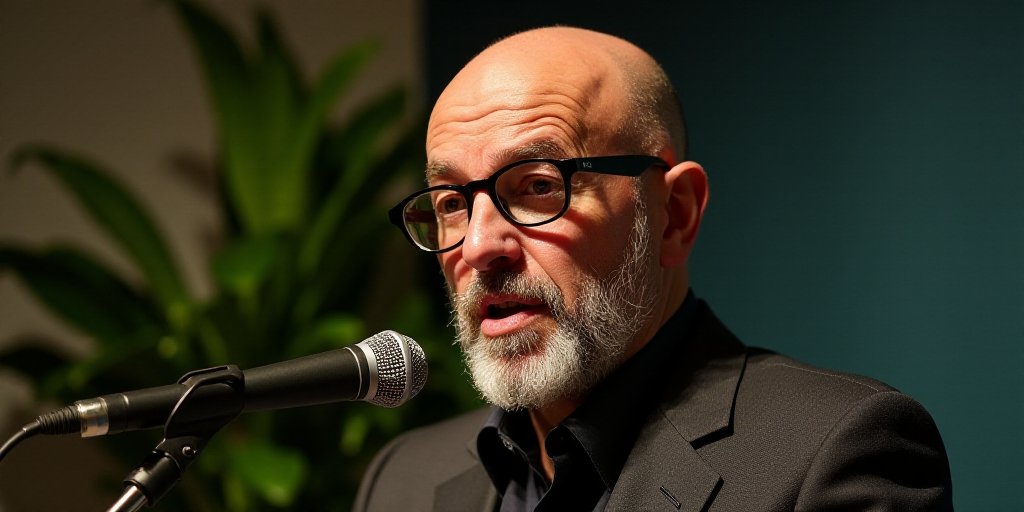

“We genuinely enjoy working with SMEs. We aim to invest more in this sector and believe we can achieve these goals,” states Felipe García, CEO of Banco Santander México.

Collaborating with the Government and Opening New Markets

In an interview with El Economista, García explains that the government’s Plan México aims to develop industries to replace certain imports due to the tariff environment. Santander, with its global business relationships, can assist in opening new markets where the group has a presence.

“We believe we can significantly contribute to helping the current government recover economic activity, resume growth, and create jobs by lending more to SMEs. We view this project favorably, and it’s beneficial for all banks to contribute,” García adds.

Prioritizing SMEs and Collaborating with Authorities

Santander sees SMEs as a priority sector and is working with authorities to find the best ways to collaborate. They have already signed 22 agreements with different states to support SMEs.

“Clearly, this is a priority sector for us, the government, and where we believe we can make a difference,” García emphasizes.

Identifying and Supporting SMEs

García acknowledges that identifying where SMEs are located, their needs, and financial data is crucial for making informed credit decisions.

- Understanding SMEs’ market reach

- Assessing their lending capacity and required amounts

- Identifying areas for financial education and advisory support

- Determining potential expansion opportunities

Mexico’s Future Amid Trade Uncertainty

Despite the current uncertainty, primarily due to trade issues, García believes Mexico will benefit compared to other countries in the long run.

- Gaining some competitiveness relative to the US, despite possible tariffs

- Confident in the continued integration of the North American block, including Canada, the US, and Mexico

Although economic growth is not expected this year, Santander anticipates business growth across nearly all segments.

Key Questions and Answers

- What segment does Banco Santander México prioritize? Small and Medium Enterprises (SMEs)

- What is the goal of the Mexico Plan by the Federal Government regarding SMEs? To have 30% of SMEs access formal financing by 2030

- How does Banco Santander México plan to support SMEs? By investing more in the sector, collaborating with authorities, and signing agreements with different states

- What challenges does García mention regarding SMEs? The need to identify SME locations, understand their needs, and access their financial data for informed credit decisions

- How does García view Mexico’s future amid trade uncertainty? Optimistic, believing Mexico will gain competitiveness relative to the US and remain part of a strongly integrated North American block