Background on Copper and Its Importance

Copper, a crucial metal in the global economy, plays a significant role in various industries such as construction, electrical wiring, and technology. It is widely recognized for its excellent conductivity and durability. The metal’s price fluctuations can have substantial impacts on the economies of major copper-producing countries, including Chile, which is the world’s largest copper exporter.

Recent Copper Price Developments

Copper prices have been on the rise, nearing their 16-month peak reached in the previous session. This surge is primarily driven by concerns over continuous disruptions in copper mines across Chile, Congo, and Indonesia.

- On the London Metal Exchange (LME), three-month copper gained 0.6% to $10,717 per metric tonne, just shy of its May 2024 high of $10,800 per tonne.

- Year-to-date, copper prices on the LME have increased by 22%, fueled by recent issues in copper mines.

Mining Disruptions Affecting Copper Production

Several significant mining incidents have contributed to the current copper supply constraints:

- Operations at Indonesia’s Grasberg mine, one of the world’s largest copper deposits, have been halted for nearly a month following a mudslide that claimed seven lives.

- Interruptions have also occurred in Kamoa-Kakula, located in the Democratic Republic of Congo.

- Chile’s El Teniente mine has experienced disruptions as well.

Expert Opinions on Copper Price Trajectory

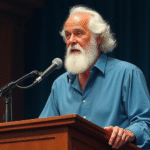

Dan Smith, Director of Commodity Market Analytics, commented on the situation:

“The disruptions are obviously massive, so I thought copper would rise faster than it has, but the dollar is strengthening a bit.”

Citi’s Upward Adjustment of Copper Price Forecast

Citi recently increased its three-month price target for LME copper to $11,000 per tonne from $10,500 per tonne, according to a note released on Tuesday.

“We forecast a growth rebound in 2026 that will catalyze copper to $12,000 per tonne by the second quarter of 2026. However, multiple catalysts could push this price target earlier.”

Key Resistance Levels for Copper Prices

Copper prices on the LME are approaching a crucial resistance band ranging from $10,750 to just under $11,000 per tonne. This level has not been surpassed in three previous instances: May 2021, March 2022, and May 2024, according to Smith.

Investor Sentiment Regarding Dollar Strength

Despite the strengthening US dollar, which benefits from the depreciation of the euro and yen, investors seem to be disregarding its impact on copper prices. A stronger dollar makes US-denominated assets more expensive for buyers using other currencies.

Performance of Other Base Metals

- Aluminum on the LME rose 0.7% to $2,743.5 per tonne.

- Zinc gained 1.3% to $3,044.50.

- Lead advanced 0.3% to $2,011.

- Nickel climbed 0.1% to $15,490.

- Tin fell 1.1% to $36,400.

Key Questions and Answers

- Q: Why are copper prices rising? A: Copper prices have surged due to concerns over continuous disruptions in copper mines across Chile, Congo, and Indonesia.

- Q: What is the significance of the 16-month high for copper? A: The approaching 16-month high highlights the growing supply constraints and heightened demand for copper, a vital metal in numerous industries.

- Q: How has Citi adjusted its copper price forecast? A: Citi increased its three-month price target for LME copper to $11,000 per tonne from $10,500 per tonne.

- Q: What is the current resistance level for copper prices? A: Copper prices are nearing a crucial resistance band ranging from $10,750 to just under $11,000 per tonne.

- Q: How are investors reacting to the strengthening US dollar? A: Despite the stronger dollar, investors seem to be overlooking its impact on copper prices, focusing instead on supply disruptions.