Background on Key Figures and Relevance

Donald Trump, the former President of the United States, has been a significant figure in global trade negotiations. His recent announcement of a trade deal with the United Kingdom has had ripple effects on various markets, including precious metals like gold.Impact on Gold Prices

Following Trump’s announcement, gold prices fell nearly 2%. The spot gold dropped by 1.9% to $3,301.15 per ounce, while US gold futures declined by 2.5% to $3,306.

Bob Haberkorn, a strategist at RJO Futures, commented on the situation: “If an agreement between the US and China is reached, there will likely be downward pressure on gold prices, potentially dropping to at least $3,200.”

Anticipation of US-China Trade Agreement

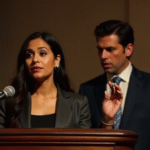

The Secretary of the Treasury, Scott Bessmer, and the US Trade Representative, Jamieson Greer, are scheduled to meet with China’s top economic official on Saturday in Switzerland. This meeting fuels hopes for a trade agreement between the two nations, which could further impact gold prices.

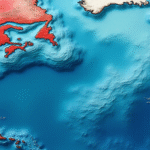

China’s Gold Demand

The People’s Bank of China recently approved currency purchases by commercial banks for paying Chinese gold imports under newly raised quotas. Zain Vawda, an analyst at MarketPulse by OANDA, explained: “In theory, this should boost gold prices due to increased Chinese demand. However, the current market dynamics are dominated by trade-related events.”

Copper Prices Rise

Reversal of Losses Due to Trump’s Trade Hopes

Copper prices increased following President Trump’s statement that he anticipated a reduction in tariffs on Chinese imports. This optimism reversed earlier losses caused by the strengthening US dollar.

The benchmark copper on the London Metal Exchange (LME) rose 0.2% to $9,439 per metric tonne.

Market Expectations of US-China Trade Relief

Traders believe that Trump’s comments have increased hopes for easing tensions between the US and China, the world’s largest consumer of industrial metals. This optimism, combined with falling inventories, has supported copper prices.