Introduction

In Mexico, discussing money laundering and terrorism financing is not a distant or specialized topic. It’s a reality that directly affects economic stability, national security, and citizens’ trust in financial institutions. Therefore, as part of the Union of Mexican Financial Institutions (UNIFIMEX), we have taken it upon ourselves to promote responsible solutions that protect users and strengthen the financial system.

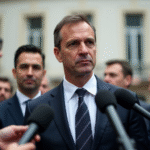

Recent Collaborative Effort

Last week, we had a significant moment in this endeavor: together with the Inter-American Development Bank (BID), we organized a high-level workshop to reinforce anti-money laundering (AML) and counter-terrorism financing (CTF) efforts. This meeting, aimed at directors general and compliance officers of financial institutions, brought together key Mexican financial institutions such as Afirme, Banco Azteca, Gentera, Consubanco, Círculo de Crédito, Banco Base, Banco Dondé, and Bancoppel, along with representatives from the State Units of Intelligence (UIPEs).

Impact of Recent Policies

The US FEND Off Fentanyl law and the designation of drug cartels as terrorist organizations have introduced a new dynamic for the financial system. Given Mexico’s geographical position and the magnitude of its financial flows, it stands at the forefront of this battle.

Key Takeaways from the Workshop

During my speech at the workshop, I emphasized that criminal methods evolve daily. Consequently, we must adapt by generating knowledge, sharing best practices, collaborating jointly, and strengthening cooperation between private institutions and the public and private sectors.

Collaboration Agreements

A crucial step was the signing of a Collaboration Agreement between UNIFIMEX and the National Commission of Anti-Money Laundering Intelligence Units (CONAUIALD), represented by Neri León. This agreement outlines five strategic axes vital for safeguarding the financial system:

- Institutional information exchange with State Intelligence Units.

- Strategic analysis of typologies and patterns, including comparative studies and risk maps.

- Joint training and seminars, both in-person and virtual.

- Research projects on compliance and illicit activity prevention.

- A public-private alert mechanism to anticipate emerging risks.

I extend my gratitude to Guillermo Lagarda, coordinator of the State Capacity Institution Knowledge Agenda, and Neri Toshiro, president of CONAUIALD. Their generous cooperation ensures these actions are not mere declarations of goodwill but concrete commitments that bolster our institutions’ response capabilities.

Importance of Financial Institutions in Mexico

The entities that make up UNIFIMEX account for over 90% of personal loans, distribute two-thirds of remittances in Mexico, and possess 30% of the nation’s financial infrastructure. In other words, we are essential actors in financial inclusion and protecting millions of Mexican families.

Impact on Trust and Economic Growth

In a country where insecurity and corruption remain significant challenges, every effort to secure the financial system’s integrity positively impacts institutional credibility. This trust enables more Mexicans to save, invest, and access credit, ultimately driving economic growth and improving living standards for Mexicans.

Key Questions and Answers

- Q: Why is addressing money laundering and terrorism financing crucial in Mexico?

A: It directly impacts economic stability, national security, and citizens’ trust in financial institutions.

- Q: What recent developments have increased the importance of these issues?

A: The US FEND Off Fentanyl law and cartel designation as terrorist organizations have introduced new dynamics for the financial system, placing Mexico at the forefront.

- Q: What agreements were signed to strengthen the financial system?

A: UNIFIMEX and CONAUIALD signed a Collaboration Agreement outlining five strategic axes for safeguarding the financial system.

- Q: How do these institutions contribute to financial inclusion and family protection?

A: They account for most personal loans, remittance distribution, and financial infrastructure, playing a vital role in financial inclusion and safeguarding millions of families.

- Q: How does strengthening the financial system benefit the economy and living standards?

A: It enhances institutional credibility, encouraging more Mexicans to save, invest, and access credit, ultimately driving economic growth and improving living standards.