Saving and Investing Behaviors

A significant portion of the wealth of Spanish households is concentrated in real estate assets. This strategy, understandable to many, limits the liquidity of these assets. According to the Bank of Spain, the foundation of the net worth of most families consists of bank deposits and savings accounts.

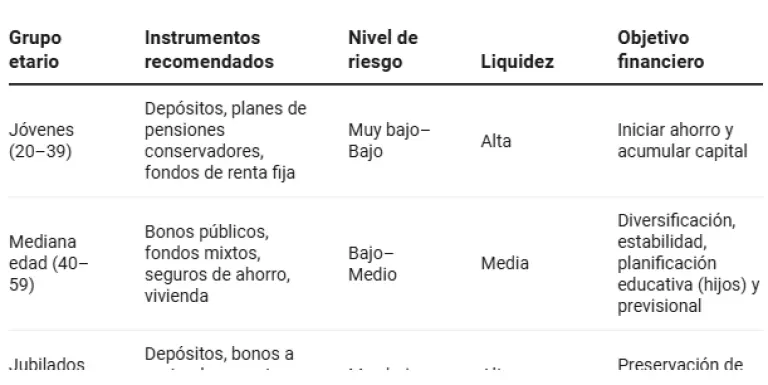

Most people prefer to allocate their financial resources to low-risk products, aiming to preserve their capital, ensure liquidity, and plan for retirement. However, the proportion between liquid assets and those with higher returns depends on age:

- Young adults (20–39 years): Although they prefer highly liquid instruments like deposits or interest-bearing accounts, they should increase their early participation in retirement savings products like pension plans.

- Middle age (40–59 years): They tend to diversify their investment portfolios more, combining housing, government bonds, savings insurance, and conservative mixed funds. This stage focuses on wealth accumulation and planning for future expenses, such as education and retirement.

- Retirees (60+ years): Recent studies on aging and secure investments suggest that retired households prioritize stability and minimize their risk exposure. Consequently, their investments focus on low-risk assets, maximizing liquidity and income stability. Deposits, short-term public bonds, and annuities are key instruments for them.

Financial planning table.

Low-Risk Financial Products

Savings accounts: allow you to save money and access it when needed. Some offer a small return and usually have no fees if certain requirements are met.

Interest-bearing accounts: similar to savings accounts, they have a more competitive return in exchange for certain conditions (such as domiciling income or limiting the maximum remunerated balance).

Fixed-term deposits: you allocate a sum of money for a specific time, in exchange for a predetermined return. The money remains unavailable until maturity but usually offers higher interest rates than the previous accounts.

Pension plans: they allow you to save for retirement with tax advantages. The invested money is not available until retirement or in exceptional circumstances, often with penalties.

Savings insurance: the saver delivers a sum of money, called the premium, to the insurer for a previously agreed-upon term, without the possibility of retrieving it before maturity. At the end of the term, they receive the invested premium and potential guaranteed returns. If they pass away, the capital and interests are transferred to their heirs.

Life annuity: A life annuity is an insurance where you invest a capital and, immediately or after a term, receive a guaranteed monthly income until death, paid by the insurance company.

Medium-Risk Financial Products

Mutual funds: they invest in variable income assets (stocks) or fixed income assets (public and private debt). They offer slightly higher returns but also greater exposure to market fluctuations.

To minimize risk, passive fund management attempts to replicate and not surpass the performance of a reference index. They construct their investment portfolio with the same values and in the same proportion as the index.

High-Risk Financial Products

Actively managed mutual funds, where fund managers decide in which values to invest, seeking higher returns at the cost of greater assumed risk.

Personal portfolio of stocks, bonds, commodities, cryptoassets, etc.: in this case, the investor buys the values directly on the market, creating their own portfolio.

Promoting Financial Stability Across Generations

Family saving and investment decisions are heavily influenced by life stages. Risk aversion increases with age, shifting portfolios towards lower-risk and volatility instruments. Housing is a predominant asset for middle-aged families, while retirees prioritize security and liquidity.

To foster intergenerational financial stability, public policies and financial education programs should promote systematic saving and retirement planning from an early age.