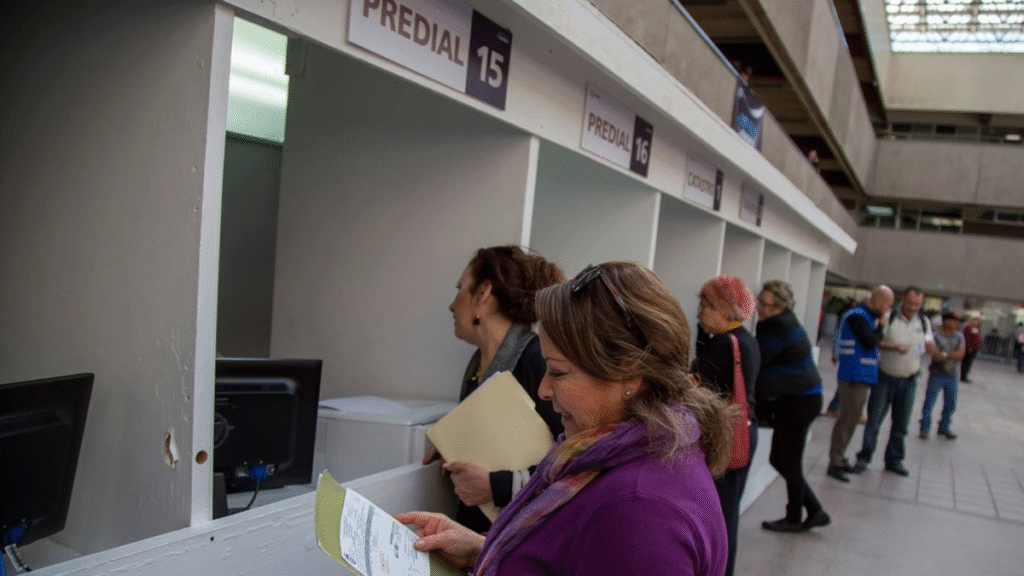

Predial Tax Discounts

The Mexico City Government has started offering discounts on predial taxes, water bills, and vehicle taxes. These tax relief measures will be available until March 31, 2026.

The Secretariat for Administration and Finance (SAF) explained that an 8% discount will be applied to annual predial payments made in January and February of 2026. Additionally, a 5% discount will be given for annual payments made during the same period.

For vulnerable groups and adults aged 60 and above, a fixed fee of 68 pesos every two months will be charged along with a 30% discount based on the property’s catastral value.

Water Discount for Vulnerable Groups

A 50% reduction in the bimestral fee for water supply rights will be applied to property owners belonging to vulnerable groups.

Vehicle Tax and Refrendo Payment Discounts

As is customary each year, a 100% discount on vehicle tax payment will be granted if the refrendo is paid. This year, however, the limit for exempting vehicle taxes has been raised from 250,000 to 638,000 pesos (including VAT) for private vehicles. This adjustment extends the benefit to more taxpayers who can afford the 2026 refrendo payment of $760 from January 1 to March 31, 2026.

Who are the Vulnerable Groups in Mexico City?

The Mexico City Government offers fixed fees and discounts on predial and water payments for the following groups: adults over 60 without fixed income or limited resources, single mothers, separated or divorced women, head-of-household women, widows, spouses of deceased property owners, orphaned pensioners, retirees or pensioners due to work-related risks and disability, individuals with permanent disabilities, and people aged 60.

Where Can I Pay Predial, Water, and Vehicle Taxes?

Payments for taxes and fees can be made at over 8,800 collection points, online, or via the “Tesorería CDMX” mobile app.

You can also make payments at tesorería kiosks, banks, convenience and department stores, as well as through the “Tesorería CDMX” mobile app and the Secretariat for Administration and Finance’s website.

For more information on discounts, benefits, and requirements, visit: https://www.finanzas.cdmx.gob.mx/programas

Key Questions and Answers

- What taxes are being discounted? Predial taxes, water bills, and vehicle taxes.

- When do the discounts apply? The predial tax discounts are available for annual payments made in January and February 2026, while water bill discounts target vulnerable groups. Vehicle tax discounts are granted with timely refrendo payments.

- Who qualifies as a vulnerable group? Adults over 60 without fixed income, single mothers, divorced or separated women, head-of-household women, widows, spouses of deceased property owners, orphaned pensioners, retirees or pensioners due to work-related risks and disability, individuals with permanent disabilities, and people aged 60.

- Where can I make the payments? Payments can be made at over 8,800 collection points, online, or via the “Tesorería CDMX” mobile app.