Background on Grupo Salinas and its Relevance

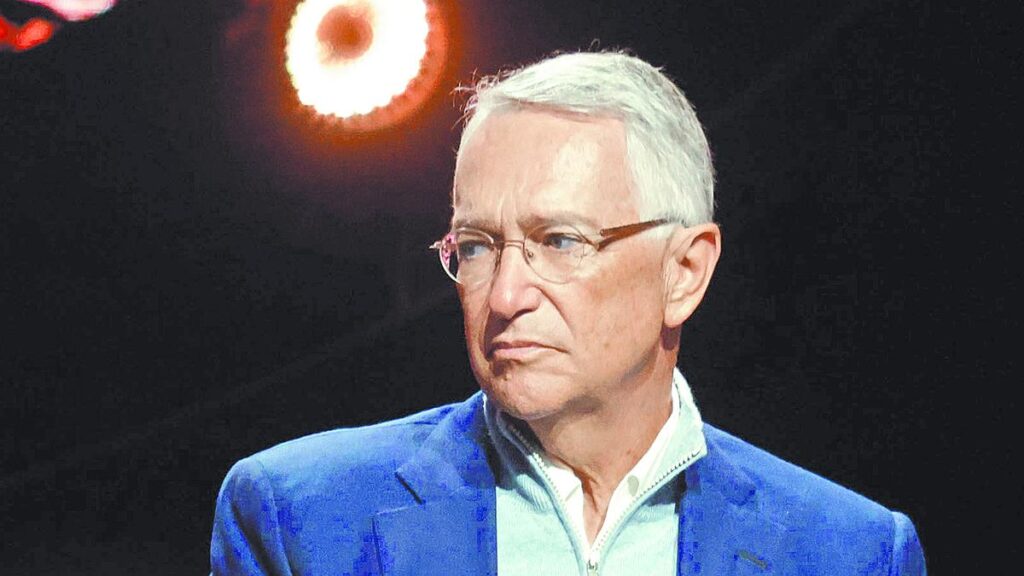

Grupo Salinas, led by entrepreneur Ricardo Salinas Pliego, is a prominent Mexican conglomerate with interests in telecommunications, financial services, and real estate. The group owns companies such as TV Azteca and Elektra, which are central to this case. Grupo Salinas has been actively involved in various business ventures and philanthropic activities, contributing significantly to Mexico’s economy and society.

The Case Details

- Grupo Salinas’ companies, Elektra and TV Azteca, promoted seven writs of amparo to challenge tax-related court rulings.

- These rulings obligated the companies to pay approximately 34,737 million pesos in tax debts.

- The Mexican Supreme Court (SCJN) unanimously dismissed all seven appeals.

Key Legal Points and Court Decision

The central issue revolved around the validity of a tax credit adjustment for Elektra, which was ordered to pay 1.431 billion pesos in unpaid income tax (ISR), along with interest, updates, and penalties for the 2008 fiscal year.

Under the SCJN’s review, the court found that the administrative act lacked proper justification for the exceptional interest rate as per constitutional Article 107, fraction IX.

As a result, the court declared the reclamation resource filed by the relevant authorities (SHCP and SAT) to be well-founded, thus revoking the admission of the amparo directo en revisión 6321/2024 promoted by the complaining company.

The tax debt related to amparo 6321/2024 amounts to approximately 33.306 billion pesos.

Grupo Salinas’ Reaction

Grupo Salinas expressed disappointment through a statement on social media, describing the day as “black” for justice and the rule of law in Mexico.

They accused the Supreme Court of acting against them without proper legal analysis, following orders from the Mexican government.

Grupo Salinas emphasized their commitment to continue fighting for their rights in national and international courts, demanding fair and accurate amounts.

Impact on Grupo Salinas

With the Supreme Court’s decisions, Grupo Salinas’ companies are now obligated to pay nearly 50 billion pesos in tax debts.

Key Questions and Answers

- What is the main issue in this case? The central issue was the validity of a tax credit adjustment for Elektra, which was ordered to pay unpaid income taxes along with interest, updates, and penalties for the 2008 fiscal year.

- How did the Supreme Court rule in this case? The SCJN unanimously dismissed all seven appeals promoted by Grupo Salinas’ companies, Elektra and TV Azteca.

- What is Grupo Salinas’ response to the court’s decision? Grupo Salinas expressed disappointment and stated their commitment to continue fighting for their rights in national and international courts, demanding fair and accurate amounts.

- What are the financial implications for Grupo Salinas? As a result of the court’s decisions, Grupo Salinas’ companies are obligated to pay nearly 50 billion pesos in tax debts.