Overview and Background

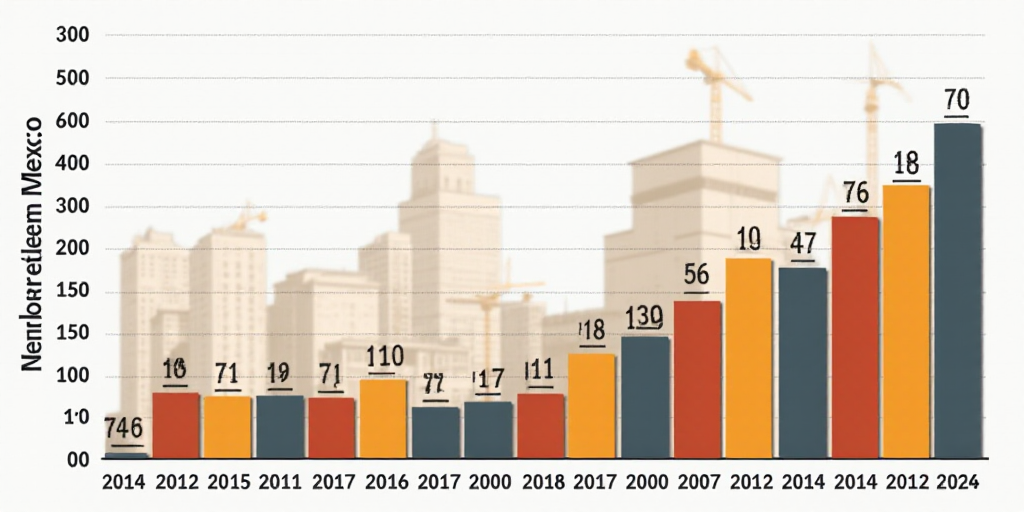

Despite public initiatives and private efforts, Mexico’s housing construction has failed to gain momentum in 2025. Between January and April, only 39,428 formal homes were built nationwide, which is 249 fewer than the same period last year.

This decline is more significant when compared to the levels reached in 2018, when the housing industry reported over 62,000 homes constructed in the same period.

Government’s Housing Goal vs. Current Progress

The stagnation contrasts with the goal of the Program for Housing Well-being, driven by the federal government, aiming to build 1.1 million homes during the six-year term through Infonavit and Conavi.

While some projects from this plan are beginning to take shape, private developers have faced persistent challenges related to financing, permits, and construction approvals for several years, according to Eduardo Torres, ai360’s executive director.

“The volume of activity has not grown; instead, placements have fallen. Although some municipalities show notable growth, state housing credits have remained stagnant or even decreased compared to a decade ago,” Torres commented.

Permits: The Key to Addressing Housing Shortage

Experts in the sector emphasize that to tackle the housing shortage, authorities must release more construction permits, particularly in urban areas close to work centers.

“The supply has not grown at the same pace as income. The government should focus on facilitating permits, as without available land and streamlined procedures, construction will not increase,” said Carlos Serrano, chief economist at BBVA Mexico.

In this regard, the National Chamber of Housing Development and Promotion (Canadevi) has reported establishing ties with Infonavit to collaborate on constructing at least 130,000 homes across 18 states in the country.

“Infonavit will provide institutional support to expedite permit and approval management. They will assist with rights regarding CFE, Conagua, and municipal permits, enabling progress in plan execution,” explained Carlos Eduardo Ramírez Capo, national president of Canadevi.

Positive Results Amidst Challenges

Despite the difficult environment, some leading housing developers in the country have reported positive results.

Companies like Ruba, Vinte, and Casas Ara have seen increases in their primary operational and financial indicators, though the growth has yet to translate into a substantial rise in national production.

Collectively, these three companies have escriturated a total of 7,463 homes during the first quarter of 2025, marking a 4.6% increase compared to the same period in 2024.

“While the international environment is volatile, our industry stands on solid pillars: a young population pyramid, the natural need for housing, a formal employment base, and access to attractive mortgage rates through institutions like Infonavit, Fovissste, and the banking sector,” said Sergio Leal Aguirre, president of Vinte.

All three developers see the president Claudia Sheinbaum’s program as an opportunity to boost housing production: “We are interested in supporting the valuable government initiatives aimed at providing dignified housing to families who have not yet had the opportunity to acquire a home,” noted Miguel Lozano Pardinas, general director of Casas Ara.

Key Questions and Answers

- What is the current state of housing construction in Mexico? Housing construction has stalled, with only 39,428 formal homes built in the first four months of 2025, which is 249 fewer than the same period last year.

- Why is housing construction struggling? Private developers face persistent challenges related to financing, permits, and construction approvals.

- What is the government’s housing goal? The Program for Housing Well-being aims to build 1.1 million homes during the six-year term.

- How can the housing shortage be addressed? Authorities must release more construction permits, especially in urban areas near work centers.

- Which housing developers have reported positive results? Ruba, Vinte, and Casas Ara have seen increases in their primary operational and financial indicators.