Overview and Key Players

As of November 2025, the assets of Mexico’s investment funds reached a total of 4.929 trillion pesos, marking an annual growth rate of 16.52%. However, this growth experienced a slight monthly contraction of -0.6% compared to October 2025, the first such decline in at least two years, according to the Mexican Securities and Exchange Commission (AMIB).

New Entrant in the Market

During the October-November reporting period, a new investment fund operator, Punto, joined the market, bringing the total number of operators to 30 and the overall number of investment funds to 632. Of these, 253 are focused on debt instruments, while 379 are geared towards equity funds.

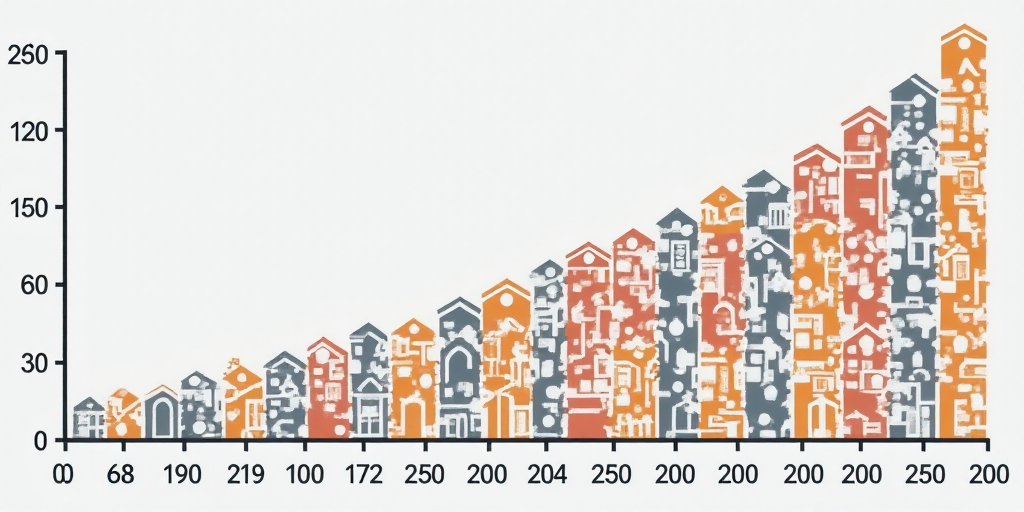

Market Leaders and Asset Distribution

BBVA remains the largest operator in the market, managing 1.190 trillion pesos in assets, which accounts for nearly 25% of the total market concentration. BlackRock follows closely with 908 billion pesos in assets, representing 19% of the market. Santander Asset Management holds third place with 487 billion pesos in assets, accounting for 10% of the market.

It’s worth noting that investment fund assets now constitute 13.5% of Mexico’s Gross Domestic Product (GDP).

Investment Focus and Operator Distribution

The investment fund sector remains heavily concentrated in debt instruments, with 75% of assets allocated to this category. The remaining 25% is invested in equity portfolios. Among operators, Santander Asset Management leads with 72 funds, followed by BBVA with 56, and Actinver with 53.

Key Questions and Answers

- What is the current status of Mexican investment funds? As of November 2025, the assets of Mexico’s investment funds stand at 4.929 trillion pesos, demonstrating an annual growth rate of 16.52%. However, there was a slight monthly contraction of -0.6% compared to October 2025.

- Who are the major players in the Mexican investment fund market? BBVA is the largest operator, managing nearly 25% of the total market assets. BlackRock follows with 19%, and Santander Asset Management holds 10%. There are currently 30 operators in total, with Santander Asset Management leading in the number of funds offered (72).

- How are assets distributed among investment types? Approximately 75% of the assets are invested in debt instruments, while 25% is allocated to equity portfolios.